Ever heard of a structured settlement? It’s a unique financial arrangement that can provide a lifeline for individuals facing significant financial challenges, particularly those who have experienced a life-altering event. Imagine receiving a steady stream of payments over time, ensuring financial stability and peace of mind. That’s the essence of a structured settlement, a concept that has gained increasing popularity in recent years.

Structured settlements are often used in cases involving personal injury, medical malpractice, or wrongful death. They offer a secure alternative to a lump-sum payment, providing a steady income stream that can help cover medical expenses, lost wages, and other financial needs. But how do these settlements work, and what are the advantages and disadvantages to consider?

What is a Structured Settlement?

A structured settlement is a way to receive a lump sum payment, typically from a personal injury lawsuit, in a series of regular payments over time. It’s like receiving a long-term annuity that provides financial security for the future.

Key Features of Structured Settlements

Structured settlements are designed to provide a steady stream of income for a specific period, ensuring that the recipient has a reliable source of funds for their needs.

- Regular Payments: Structured settlements typically involve periodic payments, such as monthly or annually, for a predetermined duration.

- Tax Advantages: Payments received from a structured settlement are often tax-free, which can be a significant financial benefit for recipients.

- Guaranteed Income: Structured settlements provide a guaranteed source of income, eliminating the risk of running out of money. This is particularly beneficial for individuals with long-term disabilities or medical expenses.

- Professional Management: A structured settlement is managed by a third-party administrator, ensuring the timely and secure disbursement of payments.

- Flexibility: Structured settlements can be customized to meet the recipient’s specific needs, such as adjusting payment amounts or durations.

Situations Where Structured Settlements Are Used

Structured settlements are often used in situations where a lump sum payment may not be the most practical or beneficial option. Here are some common examples:

- Personal Injury Lawsuits: When an individual sustains a serious injury due to negligence or wrongdoing, a structured settlement can provide long-term financial support for medical expenses, lost wages, and future care.

- Wrongful Death Claims: In cases where a loved one has passed away due to negligence, a structured settlement can provide financial security for surviving family members.

- Medical Malpractice: When medical errors result in serious injuries or death, a structured settlement can compensate the victim or their family for the financial and emotional damages incurred.

- Product Liability Cases: If a defective product causes harm, a structured settlement can provide ongoing financial support for the injured party.

How Does a Structured Settlement Work?

A structured settlement is a legal agreement where a lump-sum payment is divided into a series of payments over time. This can be a more advantageous option than receiving a single lump sum, especially for those who need financial security over a longer period.

Setting Up a Structured Settlement

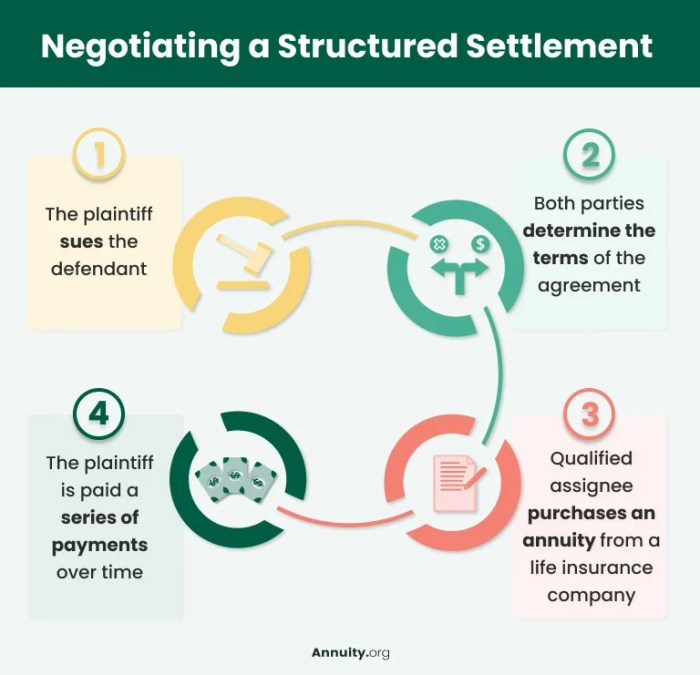

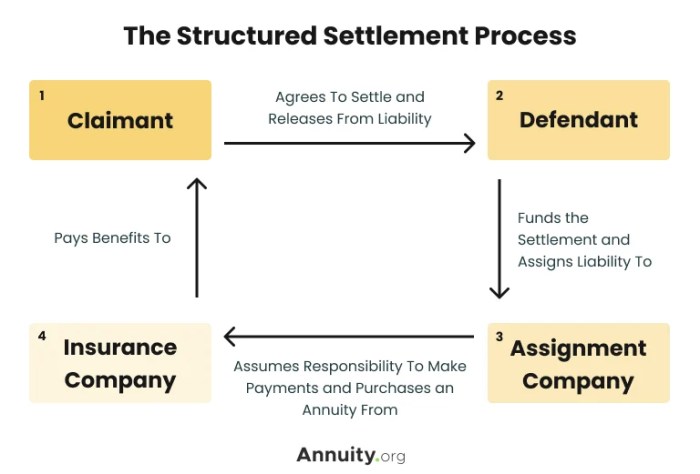

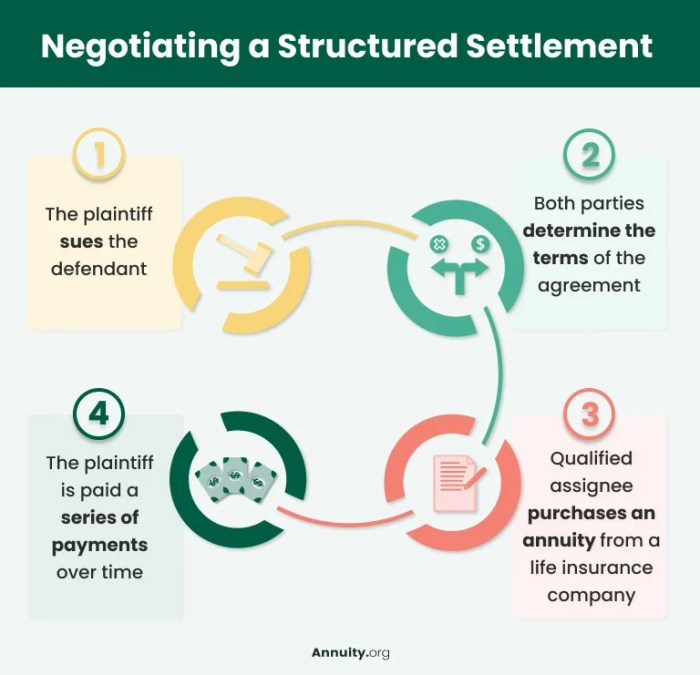

A structured settlement is typically established as part of a legal settlement, often arising from a personal injury case, a wrongful death lawsuit, or a medical malpractice claim. Here’s how the process unfolds:

- Negotiation: The parties involved in the legal case, including the plaintiff, the defendant, and their respective attorneys, negotiate the terms of the settlement. This includes determining the total amount of the settlement and how it will be structured.

- Structured Settlement Provider: Once the settlement amount is agreed upon, a structured settlement provider is chosen. This provider specializes in managing and distributing structured settlements. They will work with the parties involved to design the specific payment schedule, taking into account factors such as the plaintiff’s age, health, and financial needs.

- Agreement: The parties involved sign a formal agreement outlining the terms of the structured settlement. This agreement details the payment schedule, interest rates, and other relevant terms.

- Funding: The defendant, or their insurance company, funds the structured settlement. This money is then transferred to the structured settlement provider, who will manage and distribute the payments according to the agreed-upon schedule.

Role of a Structured Settlement Provider

Structured settlement providers play a crucial role in ensuring the smooth and efficient distribution of payments. They are responsible for:

- Payment Schedule: Designing and managing the payment schedule, ensuring that payments are made on time and in the correct amounts.

- Investment Management: Investing the funds received from the defendant to generate interest and ensure the long-term sustainability of the settlement.

- Tax Reporting: Providing tax reporting documentation to the recipient, including Form 1099-R, which reports the distribution of annuity payments.

- Other Services: Providing various other services, such as estate planning assistance, financial counseling, and beneficiary designation.

Types of Payments

Structured settlements can include a variety of payment types, depending on the needs and preferences of the recipient. Common types include:

- Periodic Payments: Regular payments made over a set period, such as monthly, quarterly, or annually. These payments can be designed to provide a consistent income stream for the recipient.

- Lump Sum Payments: A single, larger payment made at the beginning of the settlement, which can be used for immediate expenses or investments.

- Inflation Adjustments: Payments that increase over time to account for inflation, ensuring that the recipient’s purchasing power is maintained.

- Special Needs Payments: Payments specifically designed to meet the needs of individuals with disabilities, such as for medical care, education, or housing.

Tax Implications

Structured settlements have specific tax implications that recipients should understand:

- Generally Tax-Free: Payments received from a structured settlement are generally considered tax-free. This means that the recipient does not have to pay income tax on the payments.

- Interest Component: The interest earned on the invested funds is generally taxable as ordinary income.

- Consult a Tax Advisor: It is essential to consult with a qualified tax advisor to understand the specific tax implications of a structured settlement in individual circumstances.

Advantages of Structured Settlements

Structured settlements offer a unique approach to managing the financial implications of a personal injury or wrongful death. Instead of receiving a lump-sum payment, the recipient receives a series of periodic payments over time. This structure provides various financial benefits, including guaranteed payments and protection against inflation, ensuring long-term financial security.

Financial Benefits

A structured settlement provides several financial benefits that a lump-sum payment may not offer.

- Guaranteed Payments: Structured settlements guarantee regular payments for a predetermined period, ensuring a steady income stream. This eliminates the risk of running out of money, which can be a concern with a lump-sum payment.

- Inflation Protection: Most structured settlements include provisions for inflation adjustments, ensuring that the payments keep pace with the rising cost of living. This safeguards the recipient’s purchasing power over time, preventing their payments from losing value.

- Long-Term Financial Security: Structured settlements can provide long-term financial security, especially for individuals with significant medical expenses or long-term care needs. The regular payments can cover ongoing expenses, ensuring financial stability for years to come.

Comparison with Lump-Sum Payments

Structured settlements offer several advantages over lump-sum payments, making them a preferred choice for many individuals.

- Reduced Risk of Mismanagement: A lump-sum payment can be easily mismanaged, leading to financial instability. A structured settlement eliminates this risk by providing regular payments, preventing the recipient from making impulsive financial decisions.

- Protection from Financial Predators: Individuals who receive a large lump-sum payment can become targets of financial predators who may try to exploit their vulnerability. Structured settlements offer protection from such individuals by providing a steady income stream that cannot be easily accessed.

- Financial Planning and Stability: Structured settlements allow for better financial planning, as the recipient knows exactly how much income they will receive each year. This predictability makes it easier to budget for future expenses and build a solid financial foundation.

Disadvantages of Structured Settlements

Structured settlements, while offering advantages, come with potential drawbacks. It’s essential to weigh these downsides against the benefits before deciding if a structured settlement is right for you.

One major drawback is the lack of flexibility. Unlike a lump-sum payment, which you can use immediately for any purpose, a structured settlement provides a fixed stream of payments over time. This can be restrictive if you need access to a large sum of money upfront, such as for immediate medical expenses or a major life event.

Risk of Provider Bankruptcy

Structured settlements are typically funded by insurance companies or specialized financial institutions. If the provider goes bankrupt, there’s a risk that your future payments could be jeopardized. While this is rare, it’s a crucial consideration, especially if you’re relying on the settlement for long-term financial security.

Potential for Investment Loss

Structured settlements often involve investing the initial settlement amount. While this can potentially generate higher returns over time, it also exposes you to investment risk. Market fluctuations or poor investment decisions can negatively impact the value of your settlement.

Tax Implications

Structured settlements are typically taxed as ordinary income, meaning you’ll have to pay taxes on each payment you receive. This can significantly reduce the overall value of the settlement, especially if you’re in a high tax bracket.

Impact on Credit

Receiving structured settlement payments can affect your credit score, particularly if you use them as collateral for loans. This can make it more difficult to secure future financing or obtain favorable loan terms.

Comparison with Lump-Sum Payments

A lump-sum payment offers immediate access to funds, allowing for greater flexibility and control over your finances. However, it also comes with the responsibility of managing the money wisely and avoiding impulsive spending. A structured settlement provides a more predictable and potentially secure income stream but sacrifices immediate access to a large sum of money.

Common Uses of Structured Settlements

Structured settlements are a common way to receive compensation for various types of injuries or losses. They offer a flexible and structured payment plan that can provide financial stability and peace of mind over time.Structured settlements are often used in cases where there is a significant financial need, such as in personal injury cases, medical malpractice claims, and wrongful death lawsuits.

They are designed to help individuals with long-term medical expenses, lost wages, and other related costs.

Personal Injury Cases

Structured settlements are frequently used in personal injury cases, such as car accidents, slip and falls, and workplace injuries. They can provide a reliable source of income for individuals who have suffered significant injuries and are unable to work. For example, a person who has sustained a spinal cord injury may require ongoing medical care, rehabilitation, and adaptive equipment. A structured settlement can provide regular payments to cover these expenses, ensuring that the individual has the financial resources they need to live a fulfilling life.

Medical Malpractice Claims

Structured settlements are also commonly used in medical malpractice claims. These claims involve negligence by a medical professional that results in harm to a patient. For instance, a patient who suffers a birth injury due to medical negligence may require lifelong care, including specialized therapy, assistive devices, and home modifications. A structured settlement can provide a stream of payments to cover these costs, ensuring that the patient has the necessary support for their long-term needs.

Wrongful Death Lawsuits

Structured settlements are often used in wrongful death lawsuits, which involve the death of an individual due to the negligence or wrongful act of another party. These settlements can provide financial support to the surviving family members, such as a spouse or children.For example, if a parent is killed in a car accident due to another driver’s negligence, the surviving spouse and children may be entitled to compensation for lost wages, funeral expenses, and other damages.

A structured settlement can provide regular payments to help the family cover these expenses and maintain their financial stability.

Long-Term Medical Expenses

Structured settlements can be particularly beneficial for individuals with long-term medical expenses. They can provide a steady stream of payments to cover ongoing medical care, rehabilitation, and other related costs. This is especially important for individuals with chronic conditions or disabilities, who may require ongoing medical treatment for the rest of their lives. For example, a person with a severe burn injury may require numerous surgeries, skin grafts, and physical therapy over many years.

A structured settlement can provide regular payments to cover these expenses, ensuring that the individual has the financial resources they need to receive the necessary care.

Factors to Consider When Deciding on a Structured Settlement

Choosing whether a structured settlement is the right financial decision for you is a significant choice that requires careful consideration. There are several factors to weigh, including your personal circumstances, financial needs, and long-term goals.

Understanding the pros and cons of a structured settlement is essential, and it’s crucial to carefully analyze the terms of the settlement agreement. This includes understanding the payment schedule, interest rates, and any potential tax implications. Seeking professional advice from a financial advisor or attorney can provide valuable insights and help you make an informed decision.

Evaluating Your Financial Needs and Goals

It’s essential to assess your current financial situation and future needs when deciding on a structured settlement. This includes considering factors like:

- Your current income and expenses: Evaluate your current income and expenses to determine if a lump sum payment would be more beneficial for immediate financial needs or if a structured settlement would provide a more sustainable stream of income.

- Future financial goals: Consider your long-term financial goals, such as retirement planning, education expenses, or homeownership. Determine if a structured settlement aligns with these goals or if a lump sum payment would be more advantageous.

- Debt obligations: Analyze your existing debt obligations, such as mortgages, loans, or credit card debt. Consider if a lump sum payment would be helpful for debt consolidation or if a structured settlement would provide a more manageable payment schedule.

- Investment strategy: Assess your investment strategy and risk tolerance. A structured settlement can offer a steady stream of income, while a lump sum payment allows for greater flexibility in investing but also carries higher risk.

Assessing the Terms of the Settlement Agreement

Thoroughly review the terms of the settlement agreement to understand the details of the structured settlement offer. This includes:

- Payment schedule: Analyze the frequency and amount of payments, and consider if the schedule aligns with your financial needs and goals. For example, a shorter payment schedule might be beneficial for immediate needs, while a longer schedule could provide income over an extended period.

- Interest rate: Understand the interest rate applied to the settlement amount, as this impacts the total value of the settlement over time. Higher interest rates generally result in a larger overall payout.

- Tax implications: Consult with a tax advisor to understand the potential tax consequences of accepting a structured settlement. Depending on the circumstances, a portion of the payments may be subject to income tax.

- Contingency clauses: Review any contingency clauses in the agreement, such as provisions for early termination or changes to the payment schedule. These clauses could impact the value and flexibility of the settlement.

Seeking Professional Advice

It’s crucial to seek professional advice from an attorney and a financial advisor before making a decision about a structured settlement.

- Attorney: An attorney can review the settlement agreement and ensure that it protects your rights and interests. They can also provide guidance on negotiating the terms of the settlement and understanding the legal implications of your decision.

- Financial advisor: A financial advisor can help you evaluate your financial needs and goals, analyze the terms of the settlement agreement, and develop a financial plan that considers the potential impact of a structured settlement. They can also provide advice on managing your finances and investing your settlement proceeds.

Checklist of Questions to Ask Before Accepting a Structured Settlement Offer

Before accepting a structured settlement offer, consider asking the following questions:

- What are the payment terms of the structured settlement, including the frequency and amount of payments?

- What is the interest rate applied to the settlement amount?

- Are there any contingency clauses in the agreement that could affect the payments?

- What are the potential tax implications of accepting a structured settlement?

- How will the structured settlement impact my current and future financial goals?

- Have I consulted with an attorney and a financial advisor to ensure that this decision is in my best interests?

Ultimately, the decision of whether a structured settlement is right for you is a personal one. It’s crucial to weigh the potential benefits and drawbacks carefully, considering your individual circumstances and financial goals. Seeking professional advice from an attorney or financial advisor can help you navigate the complexities of structured settlements and make an informed decision that aligns with your long-term financial well-being.

Helpful Answers

What are the common scenarios where structured settlements are used?

Structured settlements are frequently used in personal injury cases, medical malpractice claims, and wrongful death lawsuits. They can also be used in cases involving product liability, environmental contamination, and other situations where significant financial compensation is required.

Can I change my mind about a structured settlement after I’ve agreed to it?

Generally, once you’ve signed a structured settlement agreement, it’s legally binding. However, there may be some circumstances, such as unforeseen changes in your financial situation, that could warrant a modification. It’s important to discuss these possibilities with your attorney before finalizing the agreement.

How long do structured settlement payments last?

The duration of structured settlement payments can vary depending on the specific terms of the agreement. Some settlements may provide payments for a fixed period, while others may continue for the lifetime of the recipient. It’s crucial to understand the payment schedule before accepting a structured settlement offer.

What happens if the structured settlement provider goes bankrupt?

Structured settlements are typically backed by insurance companies or specialized financial institutions. While bankruptcy is rare, it’s essential to choose a provider with a strong financial track record to minimize this risk. In the event of bankruptcy, the settlement payments may be covered by state-run insurance programs.