A structured settlement is a powerful financial tool, offering guaranteed payments and tax advantages. But what happens when unforeseen circumstances arise, and creditors come knocking? This guide explores the threats posed to your structured settlement and equips you with the knowledge and strategies to safeguard your financial future.

Structured settlements, often awarded in personal injury cases, provide a stream of income over time. This can be incredibly beneficial, but it also makes them a target for creditors seeking to seize these funds. Understanding the legal landscape and available protections is crucial to ensure your structured settlement remains secure.

Understanding Structured Settlements

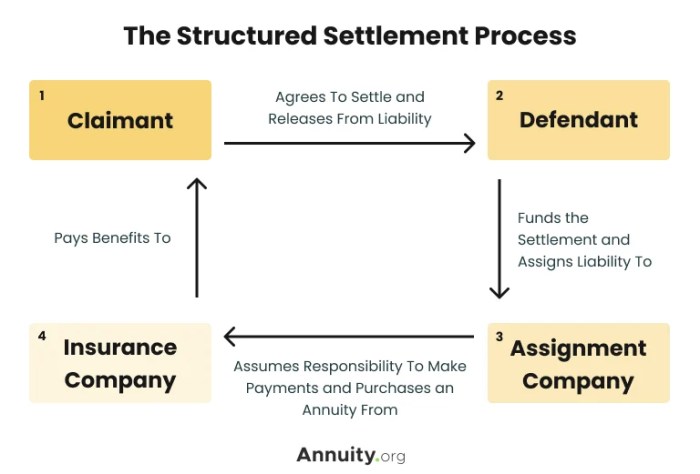

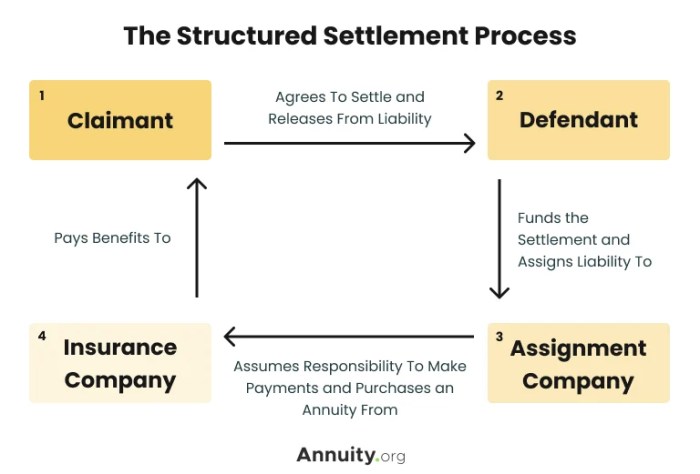

A structured settlement is a legal agreement that provides regular payments to an individual who has received a personal injury settlement or a wrongful death award. It is a way to ensure that the injured party receives ongoing financial support to cover medical expenses, lost wages, and other related costs.

The Purpose and Function of Structured Settlements

Structured settlements are designed to provide long-term financial security for individuals who have experienced significant life-altering events. They offer a structured stream of payments, typically spread out over several years or even decades, ensuring that the recipient has a reliable source of income. The payments can be tailored to meet the specific needs of the recipient, taking into account factors such as age, medical expenses, and future income potential.

Benefits of Structured Settlements

Structured settlements offer several advantages over lump-sum settlements, making them an attractive option for many individuals.

- Tax Advantages: Payments received from a structured settlement are generally tax-free. This means that recipients can keep more of their settlement money, allowing them to maximize their financial resources.

- Guaranteed Payments: Structured settlements provide a guaranteed stream of income, eliminating the risk of running out of money or making poor financial decisions.

- Protection from Creditors: Structured settlements are typically protected from creditors, meaning that they cannot be seized to satisfy debts. This provides a valuable safety net for recipients, ensuring that their future financial security is not jeopardized.

- Professional Management: Structured settlements are often managed by a third-party trustee, who ensures that payments are made on time and in accordance with the terms of the agreement. This can provide peace of mind for recipients, knowing that their funds are being handled responsibly.

Real-World Examples of Structured Settlements

Structured settlements are commonly used in a wide range of personal injury cases, including:

- Car Accidents: Victims of car accidents may receive structured settlements to cover medical expenses, lost wages, and pain and suffering.

- Medical Malpractice: Individuals who have suffered harm due to medical negligence may receive structured settlements to compensate for their injuries and ongoing care.

- Workplace Injuries: Workers who have been injured on the job may receive structured settlements to provide financial support during their recovery and beyond.

- Wrongful Death: Families of victims who have died due to negligence or wrongful acts may receive structured settlements to cover funeral expenses, lost income, and emotional distress.

Threats to Structured Settlements

Structured settlements, while offering financial security, are not immune to various threats. These threats can arise from creditors seeking to access the funds or legal challenges that may impact the settlement’s integrity. Understanding these threats is crucial for protecting your structured settlement and ensuring its intended purpose is fulfilled.

Creditors Targeting Structured Settlements

Creditors can attempt to access structured settlement funds, seeking to satisfy outstanding debts. These attempts often involve legal processes that aim to seize a portion of the settlement payments.

- Garnishment: Creditors may attempt to garnish your structured settlement payments, directing a portion of the funds towards their debt. Garnishment procedures vary by state, and specific legal requirements must be met.

- Assignment of Rights: A creditor might ask you to assign your rights to the structured settlement, essentially transferring ownership of the payments to them. This option requires your consent and should be carefully considered due to potential implications.

- Bankruptcy Proceedings: If you file for bankruptcy, your structured settlement may be considered an asset subject to the bankruptcy court’s jurisdiction. The court may decide to distribute a portion of the settlement payments to creditors.

Protecting Your Structured Settlement

You’ve worked hard to secure your structured settlement, and it’s essential to protect this valuable asset. There are several strategies you can employ to safeguard your structured settlement from creditors, ensuring that you receive the financial support you need.

Legal Protections

State and federal laws provide various protections for structured settlements. These laws aim to prevent creditors from seizing your settlement payments, ensuring that you have access to the funds you need for your well-being.

- Bankruptcy Laws: Under federal bankruptcy laws, structured settlements are generally considered “exempt” assets, meaning creditors cannot claim them during bankruptcy proceedings. This protection ensures that your settlement payments are shielded from financial hardship, allowing you to rebuild your financial life.

- State Regulations: Many states have enacted specific laws protecting structured settlements from creditors. These laws may vary by state, so it’s crucial to consult with an attorney to understand the specific regulations in your jurisdiction. These regulations typically aim to safeguard structured settlements from garnishment, attachment, or other legal actions by creditors.

Practical Strategies

Beyond legal protections, there are practical steps you can take to safeguard your structured settlement. These strategies aim to prevent creditors from accessing your funds and ensure that you maintain control over your settlement.

- Establishing a Trust: Creating a trust is a common and effective way to protect your structured settlement. A trust is a legal entity that holds your assets, such as your settlement payments, for your benefit. By placing your settlement in a trust, you can limit the ability of creditors to claim these funds, ensuring that your financial security remains intact.

- Structured Settlement Protection Agreement: A structured settlement protection agreement (SSPA) is a legal document that can be used to protect your settlement payments from creditors. An SSPA typically involves a third-party company that assumes the responsibility for managing your settlement payments, ensuring that they are disbursed according to your instructions and protected from creditors.

- Careful Financial Management: Practicing sound financial management can help minimize the risk of creditors seeking to claim your structured settlement. This includes creating a budget, tracking your expenses, and avoiding unnecessary debt. By managing your finances responsibly, you can reduce the likelihood of facing financial hardship that might lead creditors to target your settlement.

Legal and Financial Considerations

Protecting your structured settlement involves understanding the legal and financial aspects. Seeking professional guidance from legal professionals and financial advisors can ensure you make informed decisions and safeguard your settlement.

The Role of Legal Professionals

Legal professionals play a crucial role in protecting your structured settlement. They can provide guidance on:

- Understanding your legal rights: Legal professionals can help you understand the terms of your settlement agreement and your rights under the law. This includes clarifying the payment schedule, tax implications, and any restrictions on how you can use the funds.

- Negotiating a protective agreement: If you’re considering selling your structured settlement, legal professionals can help you negotiate a favorable agreement with a settlement factoring company. They can ensure the terms of the sale are fair and protect your interests.

- Protecting your settlement from creditors: Legal professionals can help you explore legal options to shield your settlement from creditors, such as establishing a structured settlement protection trust.

Consulting with Financial Advisors

Financial advisors can provide valuable insights into managing your structured settlement funds. They can help you:

- Develop a financial plan: Financial advisors can help you create a personalized plan that aligns with your financial goals and risk tolerance. This might include strategies for investing, saving, and spending your settlement funds.

- Understand the tax implications: Structured settlements often have tax implications. Financial advisors can help you understand these implications and develop strategies for minimizing your tax burden.

- Evaluate potential investment opportunities: Financial advisors can help you evaluate different investment options, considering your risk tolerance and financial goals.

Resources and Organizations

Several resources and organizations offer guidance on protecting structured settlements. These include:

- The National Structured Settlements Trade Association (NSSTA): The NSSTA is a trade association for companies that administer structured settlements. They offer resources for consumers, including information about protecting structured settlements.

- The National Organization of Social Security Claimants’ Representatives (NOSSCR): NOSSCR is a professional organization for attorneys who represent claimants in Social Security disability cases. They offer information about structured settlements and their implications for disability benefits.

- The National Association of Consumer Advocates (NACA): NACA is a non-profit organization that advocates for consumer rights. They offer resources on a wide range of consumer issues, including financial planning and debt management.

Common Mistakes to Avoid

Protecting your structured settlement is crucial, and understanding common mistakes can help you avoid financial pitfalls. These errors can lead to losing your settlement funds, leaving you vulnerable to creditors and potentially impacting your financial security.

Failing to Understand the Terms of Your Settlement

It’s essential to thoroughly understand the terms of your structured settlement agreement. This includes the payment schedule, interest rates, and any restrictions on accessing your funds. Without this knowledge, you might unknowingly make decisions that jeopardize your financial stability.

For example, you might accept a lump sum payment without realizing the long-term financial consequences.

Protecting your structured settlement from creditors requires a proactive approach. By understanding the risks, implementing preventative measures, and seeking expert guidance, you can ensure your financial stability and peace of mind. Remember, your structured settlement is a valuable asset, and taking steps to protect it is an investment in your future.

General Inquiries

What is a structured settlement?

A structured settlement is a legal agreement that provides a series of payments over time, typically used in personal injury cases to compensate the injured party.

Can creditors access my structured settlement?

Yes, creditors may attempt to access your structured settlement funds. However, there are legal protections and strategies available to prevent this.

How can I protect my structured settlement?

You can protect your structured settlement by establishing a trust, consulting with legal professionals, and exploring available legal protections.

What are the consequences of failing to protect my structured settlement?

Failing to protect your structured settlement could result in creditors seizing your funds, jeopardizing your financial stability.