Structured settlements, often awarded in personal injury or wrongful death cases, offer a unique opportunity to build wealth over time. These settlements provide a stream of regular payments, which can be strategically reinvested to grow your financial future. But navigating the complex world of investment options can be daunting. This guide provides a comprehensive overview of how to effectively reinvest structured settlement funds, maximizing your financial potential.

Understanding the nuances of structured settlements, exploring diverse investment strategies, and building a diversified portfolio are key to achieving financial success. We’ll delve into risk management, tax implications, and ethical considerations, empowering you to make informed decisions about your future.

Understanding Structured Settlements

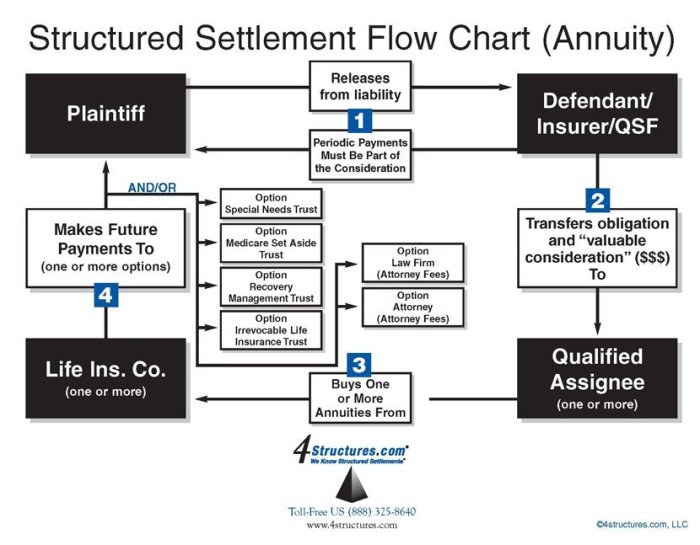

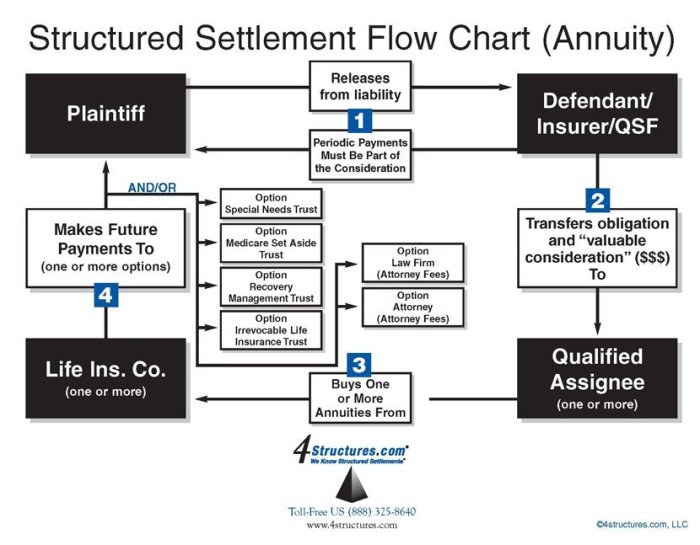

A structured settlement is a legal agreement where a lump sum payment is broken down into a series of regular payments over a set period of time. It’s a financial arrangement that provides a steady stream of income, often used in personal injury cases or wrongful death claims.

Characteristics of Structured Settlements

Structured settlements typically involve:

- Regular payments: Payments are made on a fixed schedule, usually monthly or annually, over a predetermined duration.

- Guaranteed payments: The payments are guaranteed, meaning the recipient is assured of receiving the agreed-upon amount, regardless of their financial situation.

- Inflation protection: Some structured settlements include provisions for adjusting payments to account for inflation, ensuring the purchasing power of the payments remains stable over time.

- Tax advantages: Structured settlements are generally tax-free for the recipient, meaning they don’t have to pay income tax on the payments.

Advantages of Structured Settlements

Structured settlements offer several benefits to recipients:

- Financial security: The regular payments provide a predictable income stream, reducing financial uncertainty and offering peace of mind.

- Protection against mismanagement: The structured payment plan helps prevent the recipient from spending the entire settlement sum at once, ensuring long-term financial stability.

- Financial planning: The predictable payments allow for better financial planning, enabling recipients to budget for future expenses and investments.

- Reduced tax burden: As structured settlements are tax-free, recipients can maximize the value of their settlements.

Disadvantages of Structured Settlements

While structured settlements offer significant advantages, they also come with some drawbacks:

- Limited access to funds: The recipient can’t access the entire settlement amount at once, which might not be ideal for immediate needs.

- Potential for lower overall value: In some cases, the total value of a structured settlement might be less than a lump sum payment, due to factors like interest rates and inflation.

- Flexibility limitations: The recipient is bound by the terms of the settlement agreement, limiting their ability to change payment schedules or access funds differently.

Scenarios Where Structured Settlements are Awarded

Structured settlements are commonly awarded in cases involving:

- Personal injury: Accidents, medical malpractice, and other injuries can result in structured settlements to cover medical expenses, lost wages, and pain and suffering.

- Wrongful death: In cases where a person’s death was caused by negligence or wrongful conduct, structured settlements can provide financial support to surviving family members.

- Product liability: If a defective product causes injury or death, the manufacturer or seller might be required to make structured settlements to compensate the victims.

- Mesothelioma: This type of cancer is often caused by asbestos exposure, and victims often receive structured settlements to cover medical expenses and lost income.

Reinvestment Strategies

Now that you understand structured settlements, let’s explore different ways to reinvest those funds to grow your wealth. You have a unique opportunity to leverage this steady stream of income to achieve your financial goals.

Investment Options

Reinvesting structured settlement funds opens up a range of investment opportunities. Each option carries its own risk and reward profile, so it’s crucial to understand the potential benefits and drawbacks before making any decisions.

- Traditional Investments: Stocks, bonds, mutual funds, and exchange-traded funds (ETFs) offer potential for long-term growth. Stocks represent ownership in companies, while bonds represent loans to companies or governments. Mutual funds and ETFs allow you to diversify your investments across various assets.

- Real Estate: Investing in real estate can provide income through rental properties or appreciation in value. However, it requires significant capital, ongoing maintenance, and knowledge of the local market.

- Annuities: Annuities are insurance contracts that provide guaranteed income payments for a specified period. They can be a good option for those seeking predictable cash flow.

- Business Ventures: Investing in a business venture can be a high-risk, high-reward strategy. You can become a partner in an existing business or start your own.

- Precious Metals: Gold, silver, and platinum are often seen as safe-haven assets during economic uncertainty. However, their value can fluctuate significantly.

Risk and Return Comparison

The risk and potential return of different investment strategies vary significantly. Generally, higher-risk investments have the potential for higher returns, but they also carry a greater chance of loss.

| Investment Option | Risk Level | Potential Return | Liquidity |

|---|---|---|---|

| Stocks | High | High | High |

| Bonds | Moderate | Moderate | High |

| Mutual Funds | Moderate | Moderate | High |

| Real Estate | Moderate to High | Moderate to High | Low |

| Annuities | Low | Low to Moderate | Low |

| Business Ventures | High | High | Low |

| Precious Metals | Moderate | Moderate | Moderate |

Factors to Consider

When choosing investment strategies, consider your:

- Risk Tolerance: How comfortable are you with the potential for losses?

- Investment Goals: What are you hoping to achieve with your investments?

- Time Horizon: How long do you plan to invest your funds?

- Financial Situation: How much money do you have available to invest?

Expert Advice

It’s essential to seek professional financial advice from a qualified advisor who understands structured settlements and investment strategies. They can help you develop a personalized plan that aligns with your financial goals and risk tolerance.

Building a Diversified Portfolio

Diversification is crucial when reinvesting structured settlement funds because it helps mitigate risk and maximize potential returns. By spreading investments across various asset classes, you can reduce the impact of any single investment’s underperformance on your overall portfolio. This approach ensures a balanced and resilient portfolio that can weather market fluctuations and achieve long-term growth.

Asset Classes for Diversification

Diversifying your structured settlement fund portfolio involves allocating investments across different asset classes, each with unique characteristics and risk profiles. Here are some common asset classes that can be included in a diversified portfolio:

- Stocks: Stocks represent ownership in companies and offer the potential for high returns but also carry higher risk. They can be categorized as large-cap (large companies), mid-cap (medium-sized companies), or small-cap (smaller companies).

- Bonds: Bonds are debt securities that represent loans to companies or governments. They generally offer lower returns than stocks but also carry lower risk. Bonds can be categorized based on maturity (short-term, medium-term, or long-term) and credit rating (investment grade or high-yield).

- Real Estate: Real estate investments can provide diversification and potential appreciation. This includes direct ownership of residential or commercial properties, REITs (Real Estate Investment Trusts), or real estate crowdfunding platforms.

- Commodities: Commodities are raw materials such as gold, oil, and agricultural products. They can act as an inflation hedge and provide diversification benefits.

- Cash and Cash Equivalents: Cash and cash equivalents, such as money market accounts and short-term government bonds, provide liquidity and a safe haven during market downturns.

Hypothetical Portfolio Allocation Strategy

The optimal portfolio allocation strategy depends on individual factors like risk tolerance, time horizon, and financial goals. Here’s a hypothetical example of a diversified portfolio allocation strategy for structured settlement funds, considering a long-term investment horizon and moderate risk tolerance:

| Asset Class | Allocation |

|---|---|

| Stocks | 50% |

| Bonds | 30% |

| Real Estate | 10% |

| Commodities | 5% |

| Cash and Cash Equivalents | 5% |

“This is a hypothetical example and should not be considered investment advice. Consult with a qualified financial advisor to determine the best portfolio allocation strategy for your individual circumstances.”

Managing Your Investment

Your structured settlement investment strategy is not a set-and-forget endeavor. Just as the market fluctuates, so too should your investment plan adapt to changing circumstances and your evolving financial goals. Regular monitoring and adjustments are crucial to ensuring your investment portfolio remains aligned with your objectives and maximizes your returns.

Importance of Regular Monitoring and Adjustments

Consistent monitoring of your investment portfolio allows you to identify potential issues early and make informed decisions before they escalate. This includes tracking the performance of your investments, reviewing market trends, and assessing your risk tolerance. Regular adjustments may involve rebalancing your portfolio, shifting assets between different asset classes, or even making changes to your investment strategy altogether.

“Regular monitoring and adjustments are essential for ensuring your investment portfolio remains aligned with your objectives and maximizes your returns.”

Role of Professional Financial Advisors

Navigating the complexities of investment management can be daunting, especially when dealing with significant sums of money. A professional financial advisor can provide invaluable guidance and support in managing your structured settlement funds. They can help you develop a comprehensive investment plan, diversify your portfolio, and make informed decisions based on your individual needs and financial goals.

- Investment Expertise: Financial advisors have specialized knowledge and experience in navigating various investment markets, including stocks, bonds, real estate, and alternative investments. They can help you understand the intricacies of each asset class and make informed decisions based on your risk tolerance and investment goals.

- Personalized Strategies: They can tailor investment strategies to your specific financial situation, including your age, income, and risk tolerance. This ensures your investments are aligned with your unique needs and objectives.

- Objective Perspective: It can be difficult to make objective decisions when it comes to your own money. Financial advisors provide an unbiased perspective, helping you avoid emotional biases that can negatively impact your investment decisions.

- Market Monitoring: Financial advisors continuously monitor market trends and economic conditions, identifying potential opportunities and risks. They can adjust your investment strategy accordingly, ensuring your portfolio remains aligned with your goals and objectives.

Reviewing and Adjusting Your Investment Plan

When reviewing and adjusting your investment plan, it is essential to consider several key factors. This process should be a collaborative effort between you and your financial advisor, ensuring your investment strategy remains aligned with your evolving needs and goals.

- Performance Review: Regularly assess the performance of your investments, comparing their returns against your expectations and market benchmarks. This helps identify underperforming assets and potential areas for improvement.

- Risk Tolerance Assessment: Your risk tolerance can change over time, particularly as your financial situation evolves. Periodically review your risk tolerance and adjust your investment strategy accordingly. If your risk tolerance has decreased, you may want to consider shifting towards more conservative investments.

- Financial Goals: Your financial goals may change as you progress through life. Revisit your investment plan to ensure it aligns with your current goals, such as retirement planning, education expenses, or purchasing a home. You may need to adjust your investment strategy to achieve these goals within your desired timeframe.

- Market Conditions: Economic and market conditions can impact investment performance. Regularly monitor market trends and adjust your investment strategy accordingly. This may involve shifting assets between different asset classes or adjusting your investment allocation based on prevailing market conditions.

- Tax Implications: Tax laws and regulations can impact your investment returns. Ensure your investment strategy considers potential tax implications, such as capital gains taxes, and adjust your portfolio accordingly to minimize tax liabilities.

Tax Implications

Reinvesting structured settlement funds can generate substantial returns, but it’s crucial to understand the tax implications associated with these investments. The Internal Revenue Service (IRS) classifies structured settlement payments as taxable income, and the specific tax treatment depends on the investment strategy you choose.

Tax Implications of Different Investment Options

The tax implications of reinvesting structured settlement funds can vary significantly depending on the type of investment you choose. Here’s a breakdown of the potential tax liabilities associated with common investment options:

- Stocks and Bonds: Capital gains realized from selling stocks or bonds are generally taxed at preferential rates, but dividends and interest income are taxed as ordinary income. The specific tax rate depends on your income level and the holding period of the investment. For example, short-term capital gains (held for less than a year) are taxed at your ordinary income tax rate, while long-term capital gains (held for over a year) are taxed at a lower rate, generally 0%, 15%, or 20% depending on your income level.

- Mutual Funds and ETFs: Investments in mutual funds and exchange-traded funds (ETFs) can generate both capital gains and dividend income. The tax treatment of these gains and income is similar to that of individual stocks and bonds, with capital gains being taxed at preferential rates and dividend income taxed as ordinary income. You’ll need to consult the fund’s prospectus to understand its specific tax implications.

- Real Estate: Investing in real estate can generate rental income, which is taxed as ordinary income. Capital gains realized from selling real estate are generally taxed at preferential rates, but the tax treatment can be complex and depend on factors such as the holding period and the type of property.

- Annuities: Annuities are contracts that provide a stream of income payments over time. The tax treatment of annuities depends on the type of annuity and the specific terms of the contract. In general, the income from an annuity is taxed as ordinary income, but the principal amount is tax-deferred.

Strategies for Minimizing Tax Burden

While reinvesting structured settlement funds can lead to significant tax liabilities, there are strategies to minimize your tax burden:

- Tax-Advantaged Accounts: Consider investing in tax-advantaged accounts like IRAs or 401(k)s. These accounts offer tax-deferred growth, meaning you won’t pay taxes on investment gains until you withdraw the funds in retirement. However, it’s important to note that traditional IRAs and 401(k)s typically require you to pay taxes on withdrawals in retirement, while Roth IRAs and Roth 401(k)s allow for tax-free withdrawals in retirement if certain conditions are met.

- Tax-Loss Harvesting: This strategy involves selling losing investments to offset capital gains from other investments. By strategically realizing losses, you can reduce your overall tax liability.

- Consult a Tax Professional: Seek advice from a qualified tax professional to understand the specific tax implications of your investment strategy and explore strategies for minimizing your tax burden.

Legal and Ethical Considerations

Reinvesting structured settlement funds involves significant legal and ethical considerations that require careful attention. Understanding these aspects is crucial to ensuring your investment decisions are made responsibly and in compliance with all relevant laws and regulations.

Potential Legal Pitfalls and Risks

It’s essential to be aware of the potential legal pitfalls and risks associated with reinvesting structured settlement funds. These can include:

- Violation of the Structured Settlement Protection Act (SSPA): The SSPA protects structured settlement recipients by regulating the transfer of their payments. Unauthorized or improperly structured transactions can result in legal penalties and potentially void the transfer.

- Fraudulent Schemes: Be wary of companies or individuals offering unrealistic returns or guarantees. Fraudulent schemes often target individuals seeking to maximize their structured settlement funds, leading to financial losses.

- Tax Consequences: Reinvesting structured settlement funds can have tax implications. Consult with a tax professional to understand the potential tax liability associated with your specific investment strategy.

Ethical Considerations

Beyond legal compliance, ethical considerations are paramount when managing structured settlement funds.

- Transparency and Disclosure: Ensure all parties involved in the transaction are fully informed about the terms, risks, and potential outcomes of the investment.

- Fiduciary Duty: If you are acting as a trustee or advisor for a structured settlement recipient, you have a fiduciary duty to act in their best interests and prioritize their financial well-being.

- Conflicts of Interest: Avoid any situations where your personal interests might conflict with the recipient’s best interests.

Seeking Professional Guidance

Before making any investment decisions regarding your structured settlement funds, it’s crucial to seek professional guidance from experienced legal and financial professionals.

- Structured Settlement Brokers: These professionals specialize in facilitating the transfer of structured settlement payments. They can help you understand the legal requirements, identify reputable buyers, and negotiate fair terms.

- Attorneys: An attorney specializing in structured settlements can ensure the transaction complies with the SSPA and other relevant laws. They can also advise you on the potential tax implications and protect your rights throughout the process.

- Financial Advisors: A qualified financial advisor can help you develop an investment strategy tailored to your financial goals, risk tolerance, and time horizon. They can also assist in diversifying your portfolio and managing your investments effectively.

By carefully considering your financial goals, risk tolerance, and time horizon, you can create a robust investment plan that aligns with your unique circumstances. Remember, seeking professional guidance from a qualified financial advisor can provide invaluable support and insights. With a well-structured approach, you can turn your structured settlement into a powerful engine for wealth creation, securing a brighter financial future.

Detailed FAQs

Can I access the entire lump sum of my structured settlement?

In most cases, you can’t access the entire lump sum upfront. Structured settlements are designed to provide a stream of payments over time. However, you may be able to sell your settlement rights to a third party, known as a structured settlement factoring company, for a discounted lump sum.

What are the tax implications of reinvesting structured settlement funds?

The tax implications of reinvesting structured settlement funds depend on the type of investment and the structure of the settlement itself. It’s essential to consult with a tax professional to understand your specific tax liabilities.

Is it better to invest in a single asset class or diversify?

Diversification is generally considered a sound strategy for mitigating risk. Spreading your investments across different asset classes, such as stocks, bonds, and real estate, can help to reduce volatility and potentially enhance returns over the long term.