Planning for college is a significant financial undertaking, and exploring all available resources is essential. Structured settlements, often awarded in personal injury cases, provide a stream of payments over time. But can these funds be used to cover the rising costs of higher education? This article delves into the legal and practical considerations of utilizing structured settlements for college tuition payments.

We’ll examine the legal framework surrounding this approach, explore potential challenges and benefits, and compare structured settlements with other college funding options like 529 plans, scholarships, and student loans. Ultimately, understanding the nuances of structured settlements and their applicability to college expenses is crucial for making informed financial decisions.

Understanding Structured Settlements

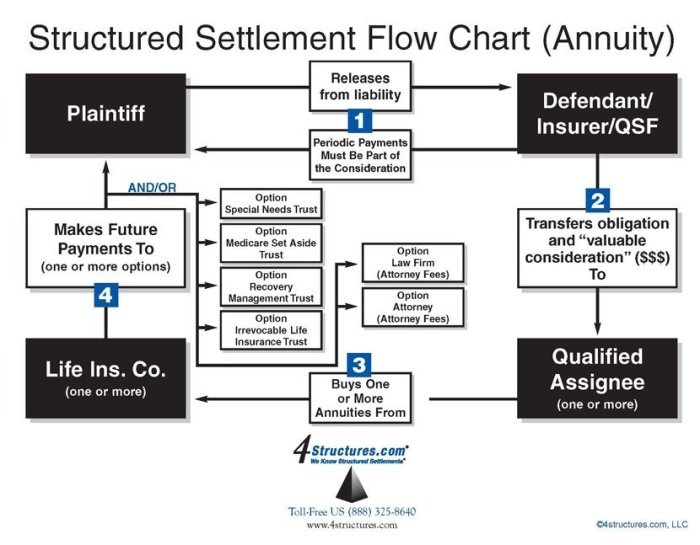

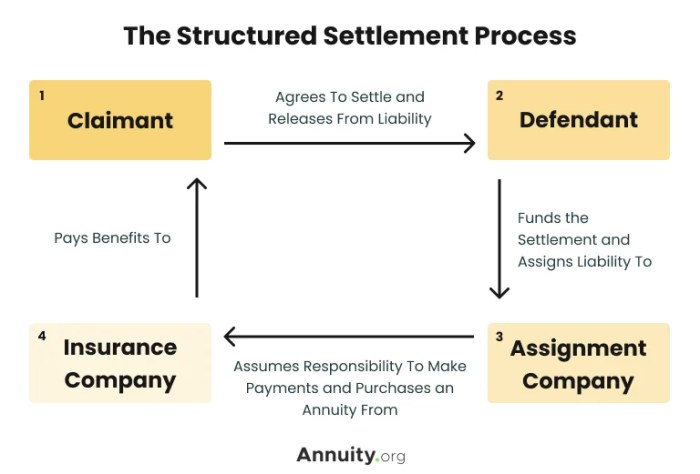

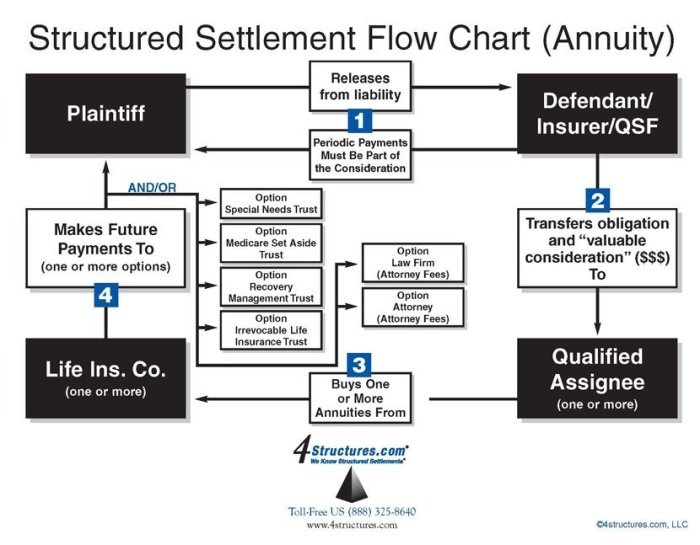

A structured settlement is a legal agreement that replaces a lump-sum payment with a series of regular payments over time. This arrangement is often used in personal injury cases, where the injured party receives a structured settlement instead of a one-time payout. The primary purpose of a structured settlement is to provide a steady stream of income to the injured party, ensuring financial security and stability.

Components of a Structured Settlement

Structured settlements typically consist of three main components:

- Periodic Payments: These are the regular payments made to the recipient, usually on a monthly, quarterly, or annual basis. The frequency and amount of payments are determined by the terms of the settlement agreement.

- Interest Rates: Structured settlements often involve an interest rate, which is applied to the principal amount of the settlement. This interest rate can vary depending on factors like the length of the settlement, the age of the recipient, and prevailing market conditions.

- Tax Implications: The tax treatment of structured settlements can vary depending on the nature of the underlying claim. In many cases, the periodic payments are considered tax-free, while the interest earned on the settlement may be subject to taxation.

Scenarios Where Structured Settlements Are Used

Structured settlements are commonly used in a variety of scenarios, including:

- Personal Injury Cases: These settlements are frequently used to compensate individuals who have suffered injuries due to negligence or other wrongful acts. For example, a victim of a car accident might receive a structured settlement to cover medical expenses, lost wages, and pain and suffering.

- Medical Malpractice Cases: When a medical professional’s negligence leads to harm, structured settlements can provide financial compensation to the injured party. This can cover medical costs, lost income, and other damages.

- Product Liability Cases: If a defective product causes injury, a structured settlement might be used to compensate the injured party. This can include payments for medical expenses, lost wages, and pain and suffering.

- Wrongful Death Cases: In cases where a death is caused by negligence or other wrongful acts, structured settlements can provide financial support to the surviving family members. This can include payments for funeral expenses, lost income, and other damages.

College Tuition and Structured Settlements

Structured settlements can be a valuable resource for funding college education, providing a steady stream of income to cover tuition, fees, and living expenses. However, navigating the legal and practical aspects of using these funds for education requires careful planning and understanding.

Legal Considerations

The legal framework surrounding the use of structured settlement funds for college tuition is governed by state laws and federal regulations.

- State Laws: Some states have specific laws that allow structured settlement funds to be used for educational expenses. These laws may Artikel procedures for accessing the funds and may impose restrictions on how they can be used.

- Federal Regulations: Federal regulations, such as the Structured Settlement Protection Act (SSPA), aim to protect structured settlement recipients and ensure that they receive the full value of their settlements. These regulations may restrict the transfer of structured settlement payments, especially if the transfer is for less than the fair market value of the payments.

Practical Considerations

Using structured settlement funds for college tuition involves practical considerations, including:

- Financial Planning: It is crucial to develop a comprehensive financial plan that Artikels how the structured settlement payments will be used to cover educational expenses. This plan should factor in the timing of payments, the estimated cost of tuition, fees, and living expenses, and any potential financial aid or scholarships.

- Tax Implications: Structured settlement payments are generally tax-free. However, if the funds are used for education, certain tax implications may arise. It is essential to consult with a tax advisor to understand the potential tax consequences of using structured settlement funds for college tuition.

- Accessibility of Funds: Structured settlement payments are typically made in regular installments, often annually or semi-annually. This can make it challenging to access the funds for lump-sum expenses like tuition bills. It is important to discuss payment options with the structured settlement provider and explore strategies for managing the funds effectively.

Potential Challenges

There are potential challenges associated with using structured settlement funds for college tuition:

- Transfer Restrictions: Federal and state regulations may restrict the transfer of structured settlement payments. These restrictions are designed to protect recipients from predatory practices and ensure they receive the full value of their settlements. However, they can also create obstacles for accessing funds for education.

- Payment Timing: Structured settlement payments are typically made in regular installments, which may not align with the timing of tuition bills. This can create a financial burden for recipients who need to manage their finances effectively.

- Inflation: The value of structured settlement payments may erode over time due to inflation. This can impact the ability of the funds to cover the rising cost of college tuition.

Potential Benefits

Using structured settlement funds for college tuition offers potential benefits:

- Financial Security: Structured settlements provide a predictable and reliable source of income, which can provide financial security for recipients and their families. This can help alleviate the financial burden of college tuition and reduce student loan debt.

- Investment Potential: Structured settlement payments can be invested to generate additional income, which can help cover educational expenses and provide a financial cushion for the future.

- Flexibility: Structured settlement payments can be used for a wide range of educational expenses, including tuition, fees, room and board, and books. This flexibility can help recipients tailor their education to their specific needs and goals.

Real-World Examples

- Case Study 1: A young woman received a structured settlement after a car accident. She used the funds to pay for her college education, allowing her to pursue a degree in nursing. The structured settlement payments provided her with the financial security to focus on her studies without the burden of student loan debt.

- Case Study 2: A man who suffered a workplace injury received a structured settlement. He used the funds to pay for his son’s college tuition, enabling him to pursue a degree in engineering. The structured settlement payments provided a steady stream of income that covered tuition, fees, and living expenses.

Legal and Financial Aspects

Using structured settlement funds for education expenses requires navigating a legal and financial landscape that involves specific regulations, procedures, and potential implications. Understanding these aspects is crucial to ensure the funds are utilized effectively and responsibly.

Court Approval or Consent

Obtaining court approval or consent from the settlement administrator is essential for using structured settlement funds for education. The legal framework surrounding structured settlements emphasizes the protection of the beneficiary’s long-term financial security. Therefore, using the funds for purposes other than the original intent of the settlement typically requires judicial oversight. The process for obtaining approval typically involves filing a petition with the court that originally approved the structured settlement.

This petition must demonstrate a compelling reason for using the funds for education and provide a detailed plan for how the funds will be used. The court may also require a financial analysis to ensure the beneficiary’s future financial needs are met. The settlement administrator, who manages the structured settlement payments, also plays a crucial role in this process. They may have specific guidelines or requirements for approving the use of funds for education.

In some cases, the administrator may be able to grant consent without court intervention, depending on the terms of the settlement agreement.

Financial Implications

Using structured settlement funds for education can have significant financial implications, including potential tax liabilities and the impact on future payments.

Tax Liability

The tax treatment of structured settlement payments depends on the nature of the underlying claim. In general, payments for personal injury or wrongful death are considered tax-free. However, if the structured settlement is related to a business or investment claim, the payments may be subject to income tax. When using structured settlement funds for education, it’s essential to consult with a tax professional to determine the potential tax implications.

For example, if the funds are used for tuition, fees, and other qualified education expenses, they may be eligible for tax deductions or credits.

Impact on Future Payments

Using a portion of the structured settlement funds for education will affect the amount of future payments. It’s crucial to carefully consider the long-term impact of using the funds for education and ensure that sufficient funds remain to meet the beneficiary’s future financial needs.

A financial advisor can help assess the impact of using the funds for education on future payments and ensure that the beneficiary’s financial security is maintained.

Alternative Funding Options

While structured settlements can be a valuable resource for college funding, they are not the only option available. Understanding the advantages and disadvantages of various college funding sources can help you make informed decisions about how to finance your education.

Comparison of College Funding Options

Let’s delve into the specifics of each option and how they compare to structured settlements.

- 529 Plans: These state-sponsored savings plans offer tax advantages for saving for college. Contributions grow tax-deferred, and withdrawals for qualified educational expenses are tax-free.

- Scholarships: These grants are awarded based on academic merit, financial need, or other criteria. Scholarships do not need to be repaid.

- Student Loans: These loans provide funds for college expenses but must be repaid with interest. Federal student loans generally offer lower interest rates and more flexible repayment options than private loans.

- Structured Settlements: As previously discussed, structured settlements provide periodic payments over time. These payments can be used for various expenses, including college tuition.

Advantages and Disadvantages of Each Option

Each college funding option has its own set of pros and cons. Carefully considering these factors can help you choose the best option for your circumstances.

| Funding Option | Advantages | Disadvantages |

|---|---|---|

| 529 Plans | Tax advantages, flexibility in investment choices, potential for state tax deductions | Limited flexibility in using funds, potential for penalties if funds are not used for qualified educational expenses |

| Scholarships | Free money that does not need to be repaid, potential for significant financial assistance | Competitive application process, limited availability, may not cover all college expenses |

| Student Loans | Access to funds even without sufficient savings, flexible repayment options (for federal loans) | Interest accrues over time, potential for high debt burden, impact on credit score |

| Structured Settlements | Guaranteed payments over time, potential for tax advantages, can be used for various expenses | Limited flexibility in using funds, potential for lower returns compared to other investment options |

Planning and Management

Utilizing structured settlements for college tuition payments requires meticulous planning and effective management to ensure funds are used strategically and effectively. A well-structured plan helps maximize the benefits of this financial resource, ensuring it supports your educational goals.

Budgeting and Saving Strategies

Budgeting and saving are crucial for maximizing the use of structured settlement funds for college expenses. Creating a realistic budget and adhering to it helps avoid overspending and ensures funds are available for essential needs.

- Estimate College Expenses: Research the cost of tuition, fees, room and board, books, and other expenses at your desired institutions. Consider factors like program type, location, and living arrangements.

- Develop a Comprehensive Budget: Create a detailed budget that Artikels all anticipated college expenses, including living expenses, transportation, and personal spending. Include estimated amounts for each category and track actual spending.

- Prioritize Essential Expenses: Focus on covering essential expenses like tuition, fees, and housing before allocating funds to discretionary items. This prioritization ensures core educational needs are met.

- Seek Financial Aid and Scholarships: Explore various financial aid options, including grants, scholarships, and student loans, to supplement structured settlement funds. This reduces the financial burden and increases your access to educational resources.

- Save Regularly: Establish a savings plan and deposit a consistent amount into a designated college savings account. This builds a financial cushion and allows you to manage unexpected expenses or capitalize on opportunities like early tuition payments.

Managing Funds Effectively

Managing structured settlement funds effectively requires careful planning and adherence to a well-defined strategy.

- Consult with a Financial Advisor: Seek guidance from a qualified financial advisor experienced in structured settlement management. They can provide personalized advice on investment strategies, tax implications, and maximizing your funds.

- Establish a Separate Account: Create a dedicated bank account or trust specifically for managing structured settlement funds. This simplifies tracking, prevents commingling, and ensures funds are readily available for college expenses.

- Regularly Review Your Budget: Periodically review your budget and spending habits to ensure alignment with your financial goals. This helps identify areas for improvement and adjust your spending patterns as needed.

- Avoid Unnecessary Expenses: Be mindful of discretionary spending and prioritize essential expenses. This helps stretch your funds further and ensures they are used effectively for your education.

- Consider Tax Implications: Understand the tax implications of structured settlements and seek guidance from a tax professional. This ensures you are aware of potential tax liabilities and optimize your tax strategy.

Planning Checklist

- Assess College Goals: Define your educational aspirations, including desired program, institution, and timeline. This helps clarify your financial needs and guide your planning process.

- Estimate College Costs: Research and gather accurate estimates for tuition, fees, housing, books, and other expenses. This provides a clear picture of the financial resources required for your education.

- Evaluate Structured Settlement: Review the terms and conditions of your structured settlement, including payment schedule, interest rates, and potential tax implications. This provides a foundation for planning and budgeting.

- Develop a Financial Plan: Create a comprehensive financial plan that Artikels your budget, savings strategy, and funding sources. This helps you manage your funds effectively and achieve your educational goals.

- Seek Professional Advice: Consult with a financial advisor, tax professional, and educational counselor to obtain expert guidance and support. This ensures you make informed decisions and maximize the benefits of your structured settlement.

While utilizing structured settlements for college tuition can be a viable option in certain circumstances, it’s essential to weigh the potential benefits against the complexities involved. Careful planning, legal guidance, and a thorough understanding of the financial implications are paramount. By carefully considering all available options and consulting with financial experts, individuals can navigate the complexities of funding higher education while maximizing the potential of their structured settlement funds.

Popular Questions

Can I use my structured settlement for anything other than college tuition?

While structured settlements are often intended for specific purposes, you may be able to use them for other expenses with court approval or consent from the settlement administrator.

What are the tax implications of using a structured settlement for college?

The tax treatment of structured settlement payments can vary depending on the specific circumstances. It’s essential to consult with a tax professional to understand your individual tax obligations.

Are there any restrictions on how much I can use from my structured settlement for college?

The amount you can use for college may be limited by the terms of your structured settlement agreement or court orders. It’s crucial to review these documents carefully.