Structured settlements, often used in personal injury cases, offer a unique way to receive compensation. These agreements provide regular payments over time, ensuring financial stability for the recipient. However, life changes, and sometimes, the original terms of the agreement may no longer align with your evolving needs. This is where modifying a structured settlement can be crucial.

Modifying a structured settlement agreement can be a complex process, but it can provide significant benefits. It allows you to adapt the payment structure to address changing circumstances, such as medical expenses, educational costs, or housing needs. This article will guide you through the process of modifying a structured settlement agreement, outlining the key steps and considerations involved.

Understanding Structured Settlements

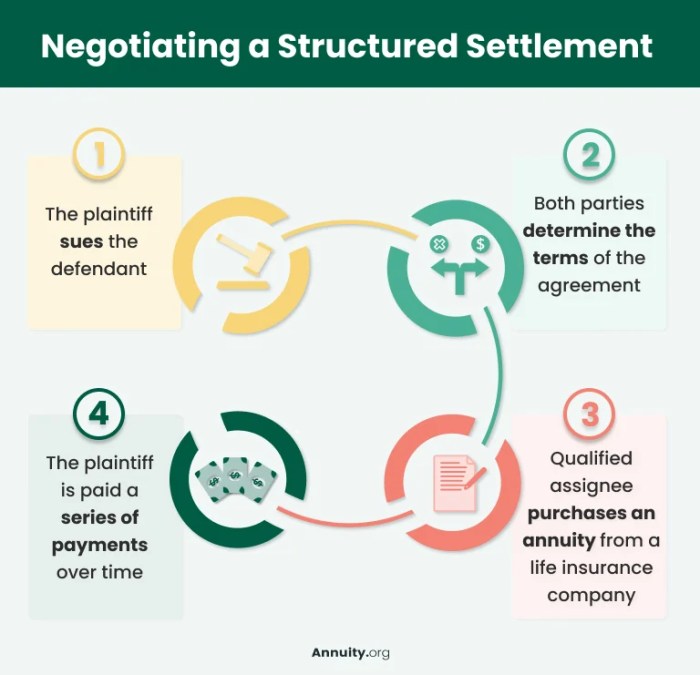

Structured settlements are a unique financial tool used to provide long-term financial security for individuals who have experienced significant injuries or losses. They are typically awarded in personal injury cases, wrongful death claims, or other legal settlements where the injured party needs ongoing financial support.Structured settlements involve a lump sum payment being divided into a series of periodic payments, often monthly or annually, over a predetermined period.

This structured approach offers several advantages, making it a popular choice for settling certain types of claims.

Components of a Structured Settlement Agreement

A structured settlement agreement is a legally binding contract that Artikels the terms of the settlement. It includes specific details about the payments, such as the amount of each payment, the frequency of payments, and the duration of the payment schedule. Here are the key components of a structured settlement agreement:

- Present Value: This represents the total value of the settlement, calculated based on the present value of all future payments. The present value is determined using a specific interest rate, which is often based on market conditions at the time of the agreement.

- Payment Schedule: The agreement Artikels the specific dates and amounts of each payment. The payment schedule can be customized to meet the individual’s needs, with options for monthly, quarterly, annual, or even lump sum payments.

- Interest Rate: The interest rate is crucial as it determines the growth of the settlement funds over time. The interest rate is typically fixed for the duration of the agreement, ensuring predictability in the future payments.

- Annuity Provider: A reputable financial institution, such as an insurance company, is responsible for managing the settlement funds and making the periodic payments to the recipient.

- Tax Implications: The agreement will specify the tax treatment of the payments. Structured settlement payments are generally considered taxable income, although there may be exceptions depending on the specific circumstances.

Benefits of Structured Settlements

Structured settlements offer several advantages over a lump sum payment, making them an attractive option for many individuals.

- Guaranteed Income Stream: Structured settlements provide a predictable and reliable income stream for the recipient, ensuring financial security over an extended period.

- Protection from Mismanagement: By entrusting the funds to a reputable annuity provider, structured settlements safeguard the recipient from potential financial mismanagement or impulsive spending.

- Tax Advantages: In some cases, structured settlements may offer tax advantages, particularly if the recipient is in a lower tax bracket during the payout period.

- Flexibility: The payment schedule can be customized to meet the recipient’s specific needs, such as providing for future medical expenses, education costs, or other financial obligations.

Drawbacks of Structured Settlements

While structured settlements offer significant benefits, there are also some potential drawbacks to consider:

- Lower Present Value: The present value of a structured settlement is typically lower than a lump sum payment, as the future payments are discounted to reflect their present value.

- Limited Flexibility: Once the agreement is signed, it can be difficult to modify the payment schedule or change the annuity provider.

- Inflation Risk: The purchasing power of future payments may be eroded by inflation, particularly if the interest rate on the settlement is lower than the inflation rate.

Reasons for Modification

Modifying a structured settlement agreement can be a crucial step in ensuring that your settlement funds are used effectively to meet your long-term needs. A structured settlement is a legal agreement that provides regular payments over time, often for a significant period. However, life is unpredictable, and circumstances can change. When these changes occur, modifying your structured settlement agreement may be necessary to adjust the payment schedule, amount, or even the way the funds are used.

Scenarios for Modification

There are several common scenarios where modifying a structured settlement agreement may become necessary. These situations often arise when unforeseen events impact your financial stability or personal needs. Here are some of the most frequent reasons for considering a modification:

- Unexpected Medical Expenses: Your health condition may deteriorate unexpectedly, requiring significant medical expenses. A modification can help secure the necessary funds for medical treatment and care.

- Changes in Family Dynamics: Divorce, remarriage, or the birth of a child can alter your financial responsibilities and necessitate a modification to ensure adequate financial support.

- Financial Hardship: Unexpected financial hardship, such as job loss or business failure, can make it challenging to manage your finances. Modifying the payment schedule or amount can provide much-needed financial relief.

- Investment Opportunities: A modification can allow you to access a lump sum payment to invest in promising opportunities that can potentially generate higher returns.

- Changes in Interest Rates: Fluctuations in interest rates can impact the value of your structured settlement payments. A modification can adjust the payment schedule or amount to reflect the current market conditions.

Consequences of Not Modifying

Failing to modify your structured settlement agreement when necessary can have significant consequences. The following are some potential outcomes:

- Insufficient Funds: If your needs exceed the original payment schedule, you may face financial hardship and struggle to cover essential expenses.

- Missed Opportunities: Not modifying your agreement may prevent you from taking advantage of lucrative investment opportunities or securing essential resources.

- Legal Disputes: If you fail to meet your financial obligations due to inadequate funds, you may face legal disputes or creditors seeking to recover their debts.

Examples of Beneficial Modifications

Numerous real-life situations demonstrate the benefits of modifying structured settlement agreements. Here are a few examples:

- A young woman with a spinal cord injury received a structured settlement for her medical expenses and lost wages. However, she later discovered that she required specialized rehabilitation services that were not covered by the original agreement. By modifying the agreement, she was able to access the necessary funds for her rehabilitation, enabling her to regain independence and improve her quality of life.

- A man who received a structured settlement after a car accident found himself in a financial bind after losing his job. By modifying the agreement, he was able to receive a lump sum payment to cover his living expenses until he found new employment. This modification prevented him from falling into debt and helped him maintain financial stability.

- A woman with a chronic illness received a structured settlement for her medical expenses and lost wages. However, she realized that the original payment schedule was insufficient to cover her long-term care needs. She successfully modified the agreement to increase the payment amount, ensuring that she had adequate funds to meet her ongoing healthcare expenses.

Modification Process

Modifying a structured settlement agreement involves a formal legal process designed to ensure fairness and protect all parties involved. The process typically involves several steps, each with specific legal requirements and procedures. Understanding these steps is crucial for anyone considering modifying their structured settlement.

Legal Requirements and Procedures

The process of modifying a structured settlement agreement is governed by state laws, and the specific requirements can vary from state to state. However, some common legal requirements and procedures generally apply:

- Notice to All Parties: The party seeking modification must formally notify all parties involved in the original settlement agreement, including the original defendant, the insurance company, and any other beneficiaries, about their intent to modify the agreement. This notice must be served according to the legal requirements of the jurisdiction.

- Grounds for Modification: The party seeking modification must demonstrate a valid legal reason for the modification. This could include a change in circumstances, such as a significant medical expense, a change in income, or a disability that was not anticipated at the time of the original agreement.

- Court Approval: In most cases, the modification requires court approval. This usually involves filing a petition with the court outlining the reasons for the modification and the proposed changes. The court will review the petition and may hold a hearing to determine if the modification is appropriate and in the best interest of all parties involved.

- Fairness and Reasonableness: The court will consider the fairness and reasonableness of the proposed modification. This includes evaluating whether the modification is necessary, whether it benefits the parties involved, and whether it is consistent with the original settlement agreement.

- Negotiation and Agreement: Before seeking court approval, the parties involved in the modification may attempt to negotiate a mutually agreeable solution. If all parties agree to the proposed changes, the court may approve the modification without a hearing.

Role of Courts and Legal Professionals

Courts play a crucial role in the modification process by ensuring that the process is fair and that the modification is in the best interest of all parties involved. Legal professionals, such as attorneys specializing in structured settlements, can provide valuable guidance and representation throughout the process. Their expertise in navigating complex legal procedures and understanding state laws can be essential for successfully modifying a structured settlement agreement.

Common Modifications

Structured settlement agreements are not set in stone. They can be modified to better suit your changing needs. Modifications can be made to address various situations, from unexpected medical expenses to educational costs. The process of modifying a structured settlement agreement involves several steps, including negotiation with the original parties involved and court approval.

Types of Modifications

Here are some common types of modifications:

- Lump Sum Advance: This involves receiving a portion of your future payments upfront. This can be helpful for immediate needs, such as medical expenses or a down payment on a house.

- Payment Frequency Change: You might want to adjust the frequency of your payments from monthly to quarterly or even annually. This can be beneficial if you prefer to manage your finances differently or if you need a larger lump sum at certain times.

- Payment Amount Change: This involves adjusting the amount of each payment, either increasing or decreasing it. For instance, you might need to increase your payments if your medical expenses are higher than expected.

- Payment Term Change: The duration of the payments can be adjusted, either shortened or extended. For example, you might want to shorten the payment term if you have a specific financial goal you want to reach sooner.

- Beneficiary Change: You can change the beneficiary of the payments, ensuring that your loved ones receive the funds in case of your death. This is particularly important if your circumstances have changed since the original agreement was made.

- Payment Purpose Change: This modification allows you to specify how the funds can be used. For example, you might restrict the use of the funds to education expenses or medical treatment.

Examples of Modifications

- Medical Expenses: If you experience unexpected medical expenses, a lump sum advance can help cover these costs. You can also adjust the payment amount to ensure you have enough to cover your ongoing medical needs.

- Education: To fund your child’s education, you might opt for a lump sum advance or change the payment frequency to receive a larger amount during their school years.

- Housing: A lump sum advance can help you purchase a home, or you can adjust the payment frequency to align with your mortgage payments.

Impact of Modifications

It’s important to understand the potential impact of modifications on the overall structure of your settlement. For instance, receiving a lump sum advance may reduce the total amount you receive over the life of the settlement.

It’s crucial to carefully consider the potential consequences of any modification before proceeding. Consulting with a financial advisor or structured settlement expert can help you make informed decisions.

Considerations for Modification

Modifying a structured settlement agreement can have significant financial and legal implications. It is crucial to understand the potential consequences before making any decisions.

Financial Implications

Modifying a structured settlement agreement can impact your financial well-being. It is essential to carefully consider the potential financial implications, including the potential loss of future payments, changes in the present value of the settlement, and the costs associated with the modification process.

For example, if you choose to receive a lump sum payment, you might lose the security of regular payments and potentially face financial difficulties in the future. You should also consider the potential for financial mismanagement and the need for proper financial planning to ensure that the lump sum payment is used wisely.

Tax Consequences

Modifying a structured settlement agreement can also have tax implications. The tax consequences of modification will depend on the specific terms of the agreement, the type of modification, and the applicable tax laws.

For instance, if you receive a lump sum payment, the entire amount might be subject to taxation. In contrast, if you choose to increase the frequency of payments, the tax implications might be less significant.

Determining the Best Course of Action

Determining the best course of action for modifying a structured settlement agreement requires careful consideration of your individual circumstances and financial goals.

- You should consult with a financial advisor and tax professional to understand the potential financial and tax implications of different modification options.

- You should also consider the long-term implications of your decision and ensure that the modification aligns with your financial goals.

- You should carefully review the terms of the settlement agreement and understand your rights and obligations.

- You should also consider the potential costs associated with the modification process, such as legal fees and administrative costs.

Modifying a structured settlement agreement can be a powerful tool for adapting to life’s changes. By understanding the process, the potential benefits, and the legal requirements involved, you can make informed decisions that ensure your financial security and meet your future needs. Consulting with a legal professional experienced in structured settlements is crucial to navigate this process effectively and ensure a successful outcome.

General Inquiries

Can I modify my structured settlement without court approval?

In most cases, court approval is required to modify a structured settlement agreement. This ensures that the modification is fair and protects all parties involved.

What are the common reasons for modifying a structured settlement?

Common reasons include changes in medical needs, unexpected expenses, educational costs, or financial hardship.

How long does it take to modify a structured settlement?

The time frame for modification can vary depending on the complexity of the case and the court’s schedule. It can range from a few months to over a year.

Are there any tax implications associated with modifying a structured settlement?

Yes, modifications can impact the tax treatment of the settlement payments. It’s essential to consult with a tax professional to understand the potential tax consequences.

What are the potential risks of modifying a structured settlement?

Risks include potential legal challenges, delays in the process, and potential changes in the payment structure that may not be favorable.