Structured settlements, often awarded in personal injury cases, provide regular payments over time. But what happens when the recipient wants to share those benefits with family? Transferring a structured settlement can be a complex process, requiring careful consideration of legal, financial, and ethical implications.

This guide will walk you through the process of transferring a structured settlement to a family member, exploring the different options, legal considerations, and factors to weigh before making a decision.

Understanding Structured Settlements

Structured settlements are a form of financial compensation that is paid out in regular installments over a period of time, rather than as a lump sum. They are often used in personal injury cases, where the recipient may have sustained significant injuries and require ongoing care.Structured settlements are designed to provide a steady stream of income to the recipient, ensuring they have financial stability while they recover and rebuild their lives.

Types of Situations Where Structured Settlements Are Used

Structured settlements are commonly used in situations where a person has sustained a serious injury or illness that has a significant impact on their life. Some common examples include:

- Personal Injury Cases: Structured settlements are often used in cases where someone has been injured in a car accident, slip and fall, or other negligence-related incident. The payments can help cover medical expenses, lost wages, and other expenses related to the injury.

- Wrongful Death Cases: In cases where a person has died due to negligence, a structured settlement can provide financial support to the surviving family members. These payments can help cover funeral expenses, lost income, and other expenses.

- Medical Malpractice Cases: When a person has been injured due to medical negligence, a structured settlement can provide compensation for medical expenses, lost wages, and pain and suffering.

Benefits of Structured Settlements for the Recipient

Structured settlements offer several benefits for the recipient, including:

- Financial Security: Regular payments provide a consistent source of income, ensuring financial stability during a difficult time.

- Protection from Financial Mismanagement: Structured settlements help prevent recipients from spending the entire settlement amount at once, which could lead to financial hardship later. The payments are spread out over time, promoting responsible financial management.

- Tax Advantages: Payments from structured settlements are often tax-free, which can significantly reduce the recipient’s tax burden.

- Long-Term Financial Planning: Structured settlements provide a predictable income stream, allowing recipients to plan for their future financial needs, such as retirement or education expenses.

Transferring a Structured Settlement

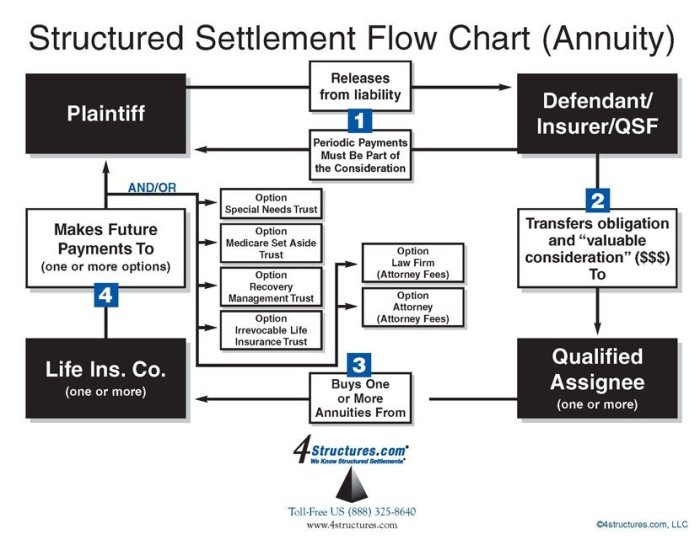

Transferring a structured settlement involves selling your future payments to a third party, typically a specialized company that purchases these types of assets. This process can be complex and requires careful consideration of the legal and financial implications.

The Legal Process of Transferring a Structured Settlement

The legal process of transferring a structured settlement typically involves the following steps:

- Obtaining a Court Order: You must obtain a court order approving the transfer. This involves filing a petition with the court that originally approved the structured settlement. The court will review the transfer agreement and ensure that it is fair and reasonable.

- Negotiating with a Structured Settlement Purchasing Company: You will need to negotiate with a structured settlement purchasing company to determine the purchase price. This price is typically based on the present value of your future payments, taking into account factors such as interest rates and your remaining life expectancy.

- Completing the Transfer Agreement: Once the purchase price is agreed upon, you will need to sign a transfer agreement with the purchasing company. This agreement will Artikel the terms of the transfer, including the purchase price, the payment schedule, and any other relevant conditions.

- Closing the Transfer: The final step involves closing the transfer, which typically involves the purchasing company making the payment to you and receiving the rights to your future payments.

Factors Affecting Transferability

Several factors can affect the transferability of a structured settlement, including:

- The Terms of the Original Settlement Agreement: Some settlement agreements may contain provisions that restrict or prohibit the transfer of payments. These restrictions should be carefully reviewed before attempting to transfer your settlement.

- State Laws: State laws vary regarding the transfer of structured settlements. Some states may have specific requirements or limitations that must be met. It is essential to consult with an attorney who is familiar with the laws in your state.

- The Age and Health of the Beneficiary: The age and health of the beneficiary can impact the value of the settlement and the likelihood of a successful transfer. Younger beneficiaries with longer life expectancies generally have more valuable settlements.

- The Amount of the Payments: Smaller settlements may be less attractive to purchasing companies due to the lower potential return on investment.

Tax Implications of Transferring a Structured Settlement

The tax implications of transferring a structured settlement can be complex and vary depending on the circumstances. In general, the transfer of a structured settlement is considered a taxable event. The difference between the purchase price paid by the purchasing company and the present value of the remaining payments is typically considered taxable income.

For example, if you receive $100,000 for the transfer of your settlement, and the present value of the remaining payments is $80,000, then the $20,000 difference would be considered taxable income.

It is essential to consult with a tax advisor to determine the specific tax implications of your transfer. They can help you understand your tax obligations and explore any potential tax-saving strategies.

Options for Transferring a Structured Settlement

There are several ways to transfer a structured settlement, each with its own advantages, disadvantages, and potential risks. Understanding these options can help you make the best decision for your specific situation.

Structured Settlement Factoring Companies

Structured settlement factoring companies purchase the rights to future structured settlement payments at a discounted rate. This provides you with a lump sum of cash immediately, but you will receive less than the total value of your payments over time.

- Advantages: Provides immediate cash, eliminates future payment uncertainty, and can be used for various purposes, such as debt consolidation, home repairs, or medical expenses.

- Disadvantages: You receive less than the total value of your payments, the discount rate can be significant, and the process can be complex and time-consuming.

- Risks: The company may go bankrupt, and you may not receive the full amount of your payments.

It is crucial to compare offers from multiple factoring companies and carefully review the terms and conditions before making a decision.

Structured Settlement Transfers

A structured settlement transfer involves selling your future payments to another party, typically an individual or an investment company. This can provide you with a lump sum of cash or a stream of payments over time, depending on the terms of the agreement.

- Advantages: Can provide a significant amount of cash, allows for flexibility in payment options, and may be a more favorable option than factoring if you need a larger amount of money.

- Disadvantages: Can be a complex process, may require legal assistance, and may involve higher fees than factoring.

- Risks: The buyer may default on payments, and you may not receive the full amount of your payments.

It is important to work with a reputable and experienced attorney to ensure that the transfer agreement is fair and protects your interests.

Structured Settlement Loans

A structured settlement loan allows you to borrow against your future payments. This option provides you with a lump sum of cash, but you will need to repay the loan with interest.

- Advantages: Provides immediate cash, can be used for various purposes, and allows you to keep your future payments.

- Disadvantages: You will need to repay the loan with interest, the interest rates can be high, and the loan may be secured by your future payments.

- Risks: You may default on the loan, and you could lose your future payments.

It is essential to compare loan terms and interest rates from multiple lenders and choose the option that best suits your needs and financial situation.

Factors to Consider Before Transferring

Transferring a structured settlement is a significant financial decision that requires careful consideration. It’s crucial to understand the potential implications and weigh them against your financial goals and circumstances.

Seeking Legal Advice

Before making any decisions about transferring your structured settlement, it’s essential to seek legal advice from an experienced attorney specializing in structured settlements. A lawyer can provide valuable insights into the complexities of the process, including the potential tax implications, legal risks, and the best course of action for your specific situation. They can also help you navigate the intricacies of the transfer process and ensure your rights are protected.

Key Considerations

- Financial Needs: Determine whether transferring your structured settlement aligns with your current and future financial needs. Evaluate whether the immediate cash flow outweighs the long-term benefits of receiving regular payments.

- Tax Implications: Understand the tax consequences of transferring your structured settlement. The transfer may be subject to capital gains taxes, which can significantly reduce the net proceeds you receive. Consult with a tax professional to determine the potential tax liability.

- Transfer Costs: Be aware of the associated costs involved in transferring your structured settlement. These costs can include legal fees, administrative fees, and potential discounting fees charged by the factoring company.

- Future Financial Security: Consider the impact of transferring your structured settlement on your long-term financial security. Regular payments from a structured settlement can provide a steady stream of income, which may be essential for retirement planning or other financial goals.

- Potential Risks: Be aware of the potential risks associated with transferring your structured settlement. These risks can include the possibility of fraud, scams, or receiving less than the fair market value for your payments.

Checklist for Review

Before making a decision, it’s beneficial to create a checklist to ensure you’ve considered all relevant factors:

- Have you sought legal advice from an experienced attorney specializing in structured settlements?

- Have you carefully reviewed the terms of your structured settlement agreement?

- Have you assessed your current and future financial needs?

- Have you researched the different transfer options available?

- Have you considered the potential tax implications of transferring your structured settlement?

- Have you compared the costs and benefits of different transfer options?

- Have you assessed the potential risks associated with transferring your structured settlement?

- Have you sought advice from a financial advisor or tax professional?

Legal Considerations for Transferring

Transferring a structured settlement is a complex process with significant legal implications. It’s crucial to understand the laws and regulations governing these transfers and the roles of all parties involved.

The Role of the Court

The court plays a vital role in approving structured settlement transfers. The court must ensure the transfer is fair and protects the interests of all parties involved, especially the original recipient of the settlement. Here’s how the court process works:

- Petition for Transfer: The person seeking to transfer the structured settlement must file a petition with the court, outlining the details of the proposed transfer. This petition must demonstrate that the transfer is in the best interests of the original recipient.

- Notice to Interested Parties: The court will notify all interested parties, including the original recipient, the structured settlement provider, and any other relevant parties, about the petition. This allows them to present their arguments and concerns to the court.

- Hearing: The court will hold a hearing to review the petition and consider the arguments of all parties. At this hearing, the court will determine whether the proposed transfer is fair and meets the legal requirements.

- Court Approval: If the court approves the transfer, it will issue an order authorizing the transfer. This order typically specifies the terms of the transfer, including the amount of the transfer, the transfer price, and the identity of the transferee.

Rights and Obligations of Parties

- Original Recipient: The original recipient has the right to be informed about the proposed transfer and to present their views to the court. They also have the right to receive a fair price for their structured settlement rights. The original recipient may be required to provide certain information to the court, such as their financial situation and their reasons for wanting to transfer the settlement.

- Transferee: The transferee is the party receiving the structured settlement rights. They are obligated to pay a fair price for the rights and to comply with the terms of the transfer agreement. The transferee may also be required to provide certain financial information to the court, such as their ability to make the payments required under the structured settlement.

- Structured Settlement Provider: The structured settlement provider is the company that issued the structured settlement. They have a legal obligation to ensure that the transfer is fair and complies with all applicable laws and regulations. The structured settlement provider may be required to provide certain information to the court, such as the terms of the structured settlement agreement and the financial health of the provider.

Ethical Considerations for Transferring

Transferring a structured settlement can be a complex financial decision with ethical implications that must be carefully considered. It’s crucial to ensure that the transfer is conducted with transparency and fairness, safeguarding the interests of all parties involved, especially the recipient of the settlement.

Transparency and Informed Consent

Transparency is essential in any financial transaction, and structured settlement transfers are no exception. The individual transferring the settlement must fully understand the implications of the transfer, including the potential financial benefits and risks. This understanding should be based on accurate and unbiased information.

“Informed consent requires that the individual transferring the settlement is fully aware of the terms of the transfer, the potential benefits and risks, and the alternatives available.”

Informed consent involves providing the individual with all the necessary information about the transfer process, including the transferor’s rights and obligations. This ensures that the individual makes a well-informed decision based on their unique circumstances and needs.

Transferring a structured settlement to a family member can be a beneficial solution for those seeking to share their financial security. However, it’s crucial to understand the legal and financial complexities involved. By seeking legal advice, exploring available options, and carefully considering all factors, you can make an informed decision that aligns with your individual needs and circumstances.

Detailed FAQs

Can I transfer my structured settlement to anyone?

Not necessarily. Transferability depends on the terms of your settlement agreement and state laws.

What are the tax implications of transferring a structured settlement?

The transfer may be subject to capital gains tax. It’s important to consult with a tax advisor.

How much does it cost to transfer a structured settlement?

The cost varies depending on the method used. Factoring companies charge fees, while legal fees may be incurred for court approval.

Is it possible to transfer a structured settlement without court approval?

In some cases, a transfer may be possible without court approval, but it’s generally recommended to seek legal counsel.

What if the recipient of the transferred settlement is a minor?

A guardian or conservator may need to be appointed to manage the transferred funds.