Have you been awarded a structured settlement, but wonder if you’re getting the most out of it? Many people who receive structured settlements are unaware that they may have the power to negotiate a higher payout. This means securing more financial support for your future needs, ensuring a more comfortable and secure path ahead. Whether you’re facing medical expenses, lost wages, or other financial burdens, understanding the intricacies of structured settlements and your negotiation options is crucial.

Negotiating a higher payout for your structured settlement is a complex process, but it’s not impossible. By understanding the factors that influence settlement value, developing effective negotiation strategies, and carefully evaluating settlement offers, you can increase your chances of securing a more favorable financial outcome.

Understanding Structured Settlements

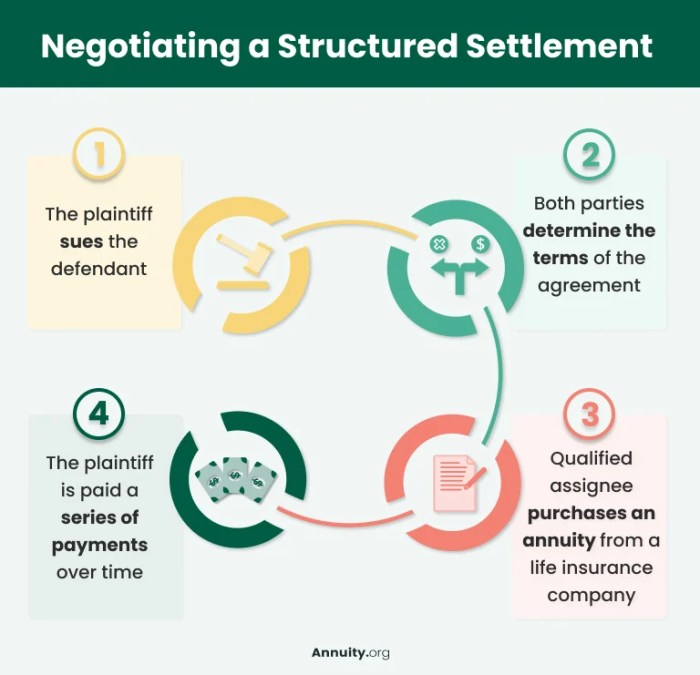

Structured settlements are a unique financial arrangement used to compensate individuals who have suffered significant injuries or losses, typically due to accidents or medical negligence. They are designed to provide a stream of regular payments over an extended period, ensuring the injured party’s financial stability and well-being.

Structure of a Structured Settlement Agreement

A structured settlement agreement Artikels the terms and conditions of the payment plan. It typically includes the following key elements:

- Present Value: The total amount of money that the settlement is worth, calculated based on the future payments and a specific discount rate. This represents the lump sum equivalent of the structured payments.

- Payment Schedule: This specifies the frequency and amount of each payment. Common payment schedules include monthly, quarterly, or annually.

- Duration: The agreement defines the total length of time over which payments will be made. This can range from a few years to a lifetime, depending on the circumstances.

- Interest Rate: The agreement specifies the interest rate used to calculate the present value of the future payments. This rate reflects the time value of money, meaning that money received today is worth more than the same amount received in the future.

- Inflation Adjustment: Some structured settlements include an inflation adjustment clause, which ensures that payments keep pace with the rising cost of living. This adjustment is typically calculated based on a specific inflation index.

Benefits of Structured Settlements

Structured settlements offer several advantages for both the injured party and the settling party.

Benefits for the Injured Party

- Financial Security: Regular payments provide a steady source of income, ensuring financial stability and reducing the risk of financial hardship.

- Long-Term Planning: The structured payments can be used to plan for future expenses, such as education, healthcare, or retirement.

- Protection from Mismanagement: Receiving regular payments can prevent the injured party from mismanaging a large lump sum settlement.

- Tax Advantages: Payments received from a structured settlement are typically taxed as ordinary income, but in some cases, they may be eligible for tax-free treatment.

Benefits for the Settling Party

- Cost Certainty: The settling party knows exactly how much they will pay over the course of the agreement, reducing the risk of future financial obligations.

- Reduced Liability: Structured settlements can help to limit the settling party’s potential liability, as they are not responsible for any future financial needs of the injured party beyond the agreed-upon payments.

- Public Relations: Structured settlements can help to improve the public image of the settling party by demonstrating a commitment to taking care of the injured party.

Types of Structured Settlements

Structured settlements can be tailored to meet the specific needs of the injured party. Some common types of structured settlements include:

- Periodic Payments: The most common type of structured settlement, where regular payments are made over a fixed period.

- Life Annuity: Payments continue for the lifetime of the injured party, providing lifelong financial security.

- Term Annuity: Payments are made for a specific term, such as 10 or 20 years.

- Deferred Annuity: Payments begin at a future date, allowing the injured party to accumulate funds for specific future needs.

- Combination Settlements: A combination of different types of structured settlements can be used to meet the unique needs of the injured party.

Factors Influencing Payout Negotiation

Negotiating a higher payout for a structured settlement involves understanding the factors that influence the potential for a successful negotiation. Several key elements contribute to the value of a settlement, and by recognizing these factors, claimants can better position themselves to achieve a favorable outcome.

Injury Severity and Long-Term Care Needs

The severity of the injury and the resulting long-term care needs significantly impact the settlement value. A more severe injury requiring extensive medical treatment, rehabilitation, and ongoing care will generally lead to a higher settlement amount. For example, a spinal cord injury resulting in permanent paralysis will likely command a higher settlement than a minor soft tissue injury. The settlement amount reflects the estimated future costs associated with medical care, lost wages, and other expenses related to the injury.

Negotiation Power of Different Claimants

The type of claimant can also influence negotiation power. Individuals may face challenges negotiating with insurance companies, especially if they lack legal representation or negotiation experience. Corporations, on the other hand, often have more leverage due to their resources, legal expertise, and ability to pursue litigation. Individuals seeking to maximize their settlement should consider the potential benefits of legal representation and expert negotiation skills.

Role of Legal Representation and Expert Negotiation Skills

Legal representation plays a crucial role in maximizing a structured settlement payout. Experienced attorneys understand the intricacies of structured settlements and can effectively advocate for their clients’ interests. They can conduct thorough research, analyze medical records, and present compelling arguments to support a higher settlement. Moreover, attorneys can negotiate with insurance companies on behalf of their clients, leveraging their expertise and knowledge of the legal system.

Expert negotiation skills are also essential in achieving a favorable outcome. Negotiators should be adept at understanding the other party’s perspective, identifying areas of compromise, and effectively communicating their clients’ needs. Effective negotiation strategies involve thorough preparation, strategic communication, and a willingness to compromise. Claimants should consider seeking legal representation and professional negotiation assistance to maximize their chances of obtaining a higher payout.

Strategies for Negotiating a Higher Payout

Negotiating a higher payout for your structured settlement requires strategic planning and effective communication. This section Artikels the key steps involved in preparing for the negotiation, effective communication strategies, persuasive arguments, and a negotiation plan.

Preparing for the Negotiation

Preparing for a structured settlement negotiation involves gathering essential information and developing a comprehensive strategy. This ensures you are well-informed and ready to advocate for your needs.

- Understand Your Settlement Agreement: Carefully review the terms of your existing structured settlement agreement. This includes the payment schedule, interest rates, and any provisions for future adjustments. Understanding the details of your current agreement will help you identify areas for potential negotiation.

- Assess Your Financial Needs: Determine your current financial situation and future financial goals. This will help you understand how a higher payout can benefit you and provide you with a clear target for your negotiation. Consider factors such as debt, medical expenses, education costs, and retirement planning.

- Research Market Values: Explore the current market values for structured settlements similar to yours. This can be achieved by consulting with financial professionals, structured settlement brokers, or online resources specializing in structured settlements. This research will provide valuable insights into the potential range of payouts for settlements with similar characteristics.

- Consider Alternative Investment Options: Explore alternative investment options that could potentially yield a higher return on your settlement funds. Consult with financial advisors to assess the risks and potential benefits of various investment strategies. This research can provide you with a solid basis for justifying your request for a higher payout.

Effective Communication Strategies

Effective communication is crucial in any negotiation. By presenting your case clearly and persuasively, you increase your chances of achieving a favorable outcome.

- Be Professional and Respectful: Maintain a professional and respectful demeanor throughout the negotiation process. Even when discussing challenging topics, it is important to demonstrate courtesy and understanding. This approach helps build rapport and fosters a positive environment for negotiations.

- Clearly Articulate Your Needs: Communicate your financial needs and goals clearly and concisely. Explain how a higher payout will help you achieve your financial objectives and improve your overall well-being. Be specific about your financial situation and the challenges you face.

- Be Prepared to Listen: Active listening is essential for understanding the other party’s perspective and potential concerns. Pay close attention to their arguments and respond thoughtfully. This demonstrates your willingness to engage in a constructive dialogue and find common ground.

- Be Willing to Compromise: Negotiation involves finding mutually acceptable solutions. Be prepared to make concessions and consider alternative options. This demonstrates your flexibility and commitment to reaching a mutually beneficial agreement.

Persuasive Arguments

When advocating for a higher payout, present compelling arguments that highlight the benefits of your request. This can involve demonstrating the financial advantages of a higher payout, highlighting the potential for a better investment strategy, or emphasizing the long-term impact on your well-being.

- Financial Benefits: Present a clear and compelling case for how a higher payout will improve your financial situation. Demonstrate how it will help you address immediate needs, reduce debt, or invest in your future. Provide specific examples of how a higher payout will positively impact your financial stability and long-term financial goals.

- Investment Opportunities: Highlight the potential for a higher payout to enable you to invest in more lucrative opportunities. Present research on alternative investment options that could yield a higher return on your settlement funds. Discuss the risks and potential benefits of these investments, ensuring you are prepared to address any concerns raised by the other party.

- Long-Term Impact: Emphasize the long-term impact of a higher payout on your overall well-being. Discuss how it will improve your quality of life, reduce financial stress, and provide you with greater peace of mind. Focus on the positive outcomes of a higher payout and its lasting benefits for your future.

Negotiation Plan

Developing a negotiation plan involves outlining your desired outcome, potential concessions, and counteroffers. This ensures you are prepared to navigate the negotiation process effectively.

- Desired Outcome: Define your desired outcome for the negotiation. This should be a clear and specific target for the payout you seek. Consider factors such as market values, your financial needs, and potential investment opportunities.

- Potential Concessions: Identify potential concessions you are willing to make in order to reach an agreement. This could involve accepting a slightly lower payout, agreeing to a specific payment schedule, or making adjustments to the terms of the settlement agreement. Be prepared to negotiate on certain aspects of the agreement to reach a mutually acceptable outcome.

- Counteroffers: Develop potential counteroffers to any proposals made by the other party. These counteroffers should be based on your desired outcome, your understanding of market values, and your willingness to compromise. Be prepared to adjust your counteroffers based on the other party’s responses and the overall progress of the negotiation.

Evaluating Settlement Offers

Carefully reviewing a settlement offer and understanding its terms is crucial before making a decision. It’s important to consider whether the offered payout aligns with your needs and long-term financial goals. Seeking independent legal advice and financial consultation can provide valuable insights and help you make an informed decision.

Comparing the Offer with Your Needs

Before accepting any settlement offer, it’s essential to compare the offered payout with your expected needs and long-term financial goals. Consider factors such as:

- Medical Expenses: The offer should cover all past and future medical expenses related to your injury or illness.

- Lost Wages: The offer should compensate for past and future lost wages due to your inability to work.

- Pain and Suffering: The offer should reflect the physical and emotional pain and suffering you’ve endured.

- Long-Term Care: If you require long-term care, the offer should cover the associated costs.

- Future Financial Goals: Consider your long-term financial goals, such as retirement, education, or homeownership, and ensure the settlement amount is sufficient to achieve them.

Seeking Independent Advice

It’s highly recommended to seek independent legal advice and financial consultation before accepting any settlement offer.

- Legal Advice: An attorney specializing in personal injury or structured settlements can review the offer’s terms and ensure they are fair and protect your rights.

- Financial Consultation: A financial advisor can help you assess your financial needs, evaluate the offer’s value, and develop a plan for managing the settlement funds.

Pros and Cons of Accepting or Rejecting

Here’s a table comparing the pros and cons of accepting or rejecting a settlement offer:

| Accepting the Offer | Rejecting the Offer | |

|---|---|---|

| Pros |

|

|

| Cons |

|

|

Resources and Support

Navigating the complex world of structured settlements can feel overwhelming, but you’re not alone. There are numerous resources available to guide you through the process, empowering you to make informed decisions and maximize your payout. This section will explore reputable organizations, online resources, and real-life examples that can help you understand and negotiate your structured settlement effectively.

Reputable Organizations

Organizations dedicated to advocating for the rights of structured settlement recipients provide valuable information and support. They offer guidance on understanding your rights, negotiating better terms, and protecting your financial future. Here are some prominent organizations:

- Structured Settlement Trade Association (SSTA): This organization represents companies involved in the structured settlement industry. While primarily focused on industry standards, they offer resources and information for recipients seeking to understand the process. You can find their website at ssta.org.

- National Association of Settlement Purchasers (NASP): This association represents companies that purchase structured settlements. While their primary focus is on facilitating these transactions, they provide information about the process and regulations. You can find their website at nasp.org.

- National Structured Settlements Trade Association (NSSTA): This organization represents brokers and other professionals involved in the structured settlement industry. They provide educational resources and information about the process. You can find their website at nssta.org.

Online Resources and Legal Databases

The internet provides a wealth of information on structured settlements and negotiation strategies. Here are some valuable online resources:

- Legal databases: Online legal databases, such as Westlaw and LexisNexis, offer access to legal case summaries, statutes, and regulations related to structured settlements. These resources can provide valuable insights into legal precedents and negotiation strategies.

- Financial websites: Financial websites, such as Investopedia and Bankrate, offer articles and guides on personal finance, including topics related to structured settlements and settlement planning. These resources can help you understand the financial implications of your settlement and develop a plan for managing your funds.

- Structured settlement websites: Several websites specialize in providing information about structured settlements, including negotiation strategies, legal resources, and industry news. These websites can be a valuable source of information and support. Some examples include StructuredSettlement.com and SettlementFunding.com.

Real-Life Cases

Numerous individuals have successfully negotiated higher payouts from their structured settlements. These cases demonstrate the power of knowledge, preparation, and skilled negotiation:

- Case 1: A young woman who received a structured settlement after a car accident successfully negotiated a higher payout by presenting a compelling case for her future needs, including education and healthcare expenses. She researched the market value of her settlement and presented a strong financial plan to justify her request. This case highlights the importance of understanding your financial needs and presenting a well-reasoned argument.

- Case 2: A man who received a structured settlement after a workplace injury negotiated a higher payout by demonstrating the impact of inflation on the future value of his settlement. He used a financial calculator to project the purchasing power of his settlement over time and presented this data to the settlement administrator. This case emphasizes the importance of considering the long-term impact of inflation on your settlement.

Expert Financial Advice and Legal Representation

Seeking professional guidance from financial advisors and legal professionals can significantly enhance your negotiating position.

- Financial advisors: A financial advisor can help you develop a comprehensive financial plan, assess the long-term implications of your settlement, and determine the most suitable investment strategies for your needs. They can also provide guidance on managing your funds and ensuring your financial security. When choosing a financial advisor, consider their experience, credentials, and reputation.

- Legal representation: An experienced attorney specializing in structured settlements can provide valuable legal advice and represent your interests during negotiations. They can help you understand your rights, identify potential legal issues, and develop a strong negotiating strategy. Legal representation can be particularly valuable when dealing with complex settlements or when you believe your rights have been violated.

While negotiating a higher payout for your structured settlement requires effort and strategic planning, it can be a worthwhile endeavor. By carefully evaluating your options, seeking expert advice, and engaging in a well-prepared negotiation process, you can potentially secure a more substantial financial foundation for your future. Remember, your well-being and financial security are paramount, and understanding your rights and options empowers you to make informed decisions that best serve your needs.

Common Queries

What are the common reasons for seeking a higher structured settlement payout?

Individuals often seek higher payouts to cover unexpected medical expenses, address long-term care needs, or simply to secure a more comfortable financial future.

How can I find a reputable lawyer or financial advisor to assist me with negotiating a structured settlement?

Look for lawyers and financial advisors specializing in structured settlements and personal injury cases. Check online directories, ask for referrals, and verify credentials and experience.

What are some red flags to watch out for when negotiating a structured settlement?

Be wary of high-pressure tactics, promises of unrealistic payouts, and agreements that lack transparency or clear terms.

What are the potential risks of accepting a structured settlement offer without careful consideration?

Risks include accepting a payout that is too low, overlooking long-term financial needs, and potentially missing out on a better settlement opportunity.