Navigating the world of structured settlements can be complex, especially when considering selling your future payments. While it might seem like a straightforward solution, many individuals make costly mistakes that can significantly impact their financial well-being. This guide aims to shed light on common pitfalls to avoid, empowering you to make informed decisions about your structured settlement.

Understanding the intricacies of structured settlements is crucial before considering a sale. These settlements, often awarded in personal injury cases, provide a stream of regular payments over time, offering financial stability and peace of mind. However, the allure of a lump sum payment can be tempting, leading some to make rash decisions without fully comprehending the potential consequences.

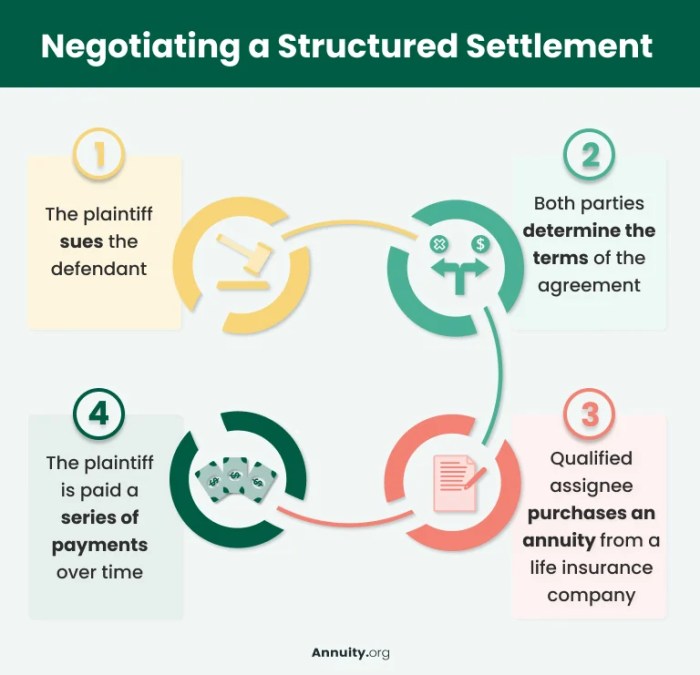

Understanding Structured Settlements

Structured settlements are a unique financial tool designed to provide a steady stream of income over time, often used in cases involving personal injury, wrongful death, or other significant legal settlements. They are a structured alternative to receiving a lump-sum payment, offering benefits for both the recipient and the payer.

Benefits of Structured Settlements

Structured settlements offer advantages for both the recipient and the payer, making them a valuable option in various legal and financial scenarios.

Benefits for the Recipient

- Financial Security: Structured settlements provide a guaranteed stream of income for a specified period, ensuring financial stability and peace of mind. This is particularly beneficial for individuals who may struggle to manage a large lump-sum payment or have concerns about long-term financial planning.

- Protection from Financial Mismanagement: Structured settlements help prevent the recipient from misusing or depleting the settlement funds quickly, ensuring the funds are used responsibly and strategically.

- Tax Advantages: In many cases, the periodic payments from a structured settlement are tax-free, offering significant financial savings compared to a lump-sum payment, which is often subject to taxes.

- Inflation Protection: Some structured settlements include provisions for periodic adjustments to the payment amount to account for inflation, ensuring the recipient’s purchasing power remains consistent over time.

Benefits for the Payer

- Reduced Liability: Structured settlements allow the payer to spread out their liability over time, reducing the immediate financial burden and potentially lowering the overall cost of the settlement.

- Predictable Cash Flow: For the payer, structured settlements provide a predictable cash flow, allowing them to budget effectively and manage their financial obligations more efficiently.

- Potential Tax Advantages: In some cases, the payer may benefit from tax deductions associated with structured settlements, further reducing their financial liability.

Common Scenarios for Structured Settlements

Structured settlements are commonly used in various situations, including:

- Personal Injury Cases: Individuals who have suffered serious injuries due to negligence or accidents often receive structured settlements to cover medical expenses, lost wages, and other damages.

- Wrongful Death Cases: Families who have lost a loved one due to negligence or wrongful conduct may receive structured settlements to compensate for the loss of income, emotional distress, and other damages.

- Medical Malpractice Cases: Individuals who have been injured due to medical negligence may receive structured settlements to cover medical expenses, lost wages, and other damages.

- Product Liability Cases: Consumers who have been injured by defective products may receive structured settlements to compensate for their injuries, medical expenses, and other damages.

Common Mistakes to Avoid When Selling a Structured Settlement

Selling a structured settlement can be a complex process, and it’s crucial to understand the potential pitfalls to avoid making costly mistakes. While selling can offer a lump sum of cash, it’s essential to weigh the pros and cons carefully. This guide will highlight common mistakes people make when selling structured settlements and explain how to navigate the process effectively.

Choosing the Wrong Buyer

It’s crucial to select a reputable buyer who offers a fair price and transparent terms. Many companies purchase structured settlements, but not all are created equal. Here’s why choosing the right buyer is critical:

- Unfair Offers: Some companies may undervalue your settlement, offering significantly less than its true worth. This can leave you with less money than anticipated, especially if you’re relying on the funds for essential expenses.

- Hidden Fees: Be wary of companies that hide fees or charges in the fine print. These hidden costs can significantly reduce your net proceeds, leaving you with a smaller amount than expected.

- Lack of Transparency: Choose a buyer who provides clear and detailed information about the process, fees, and payment terms. Transparency is essential to ensure you understand the entire transaction.

Real-Life Example: Sarah, a woman with a spinal cord injury, received a structured settlement for medical expenses and lost wages. She needed a lump sum to purchase a wheelchair-accessible van. She sold her settlement to a company that offered a seemingly attractive price. However, she later discovered hidden fees and charges that significantly reduced her net proceeds. Sarah ended up with less money than anticipated and struggled to afford the van.

Ignoring the Tax Implications

Selling a structured settlement can have significant tax implications. Understanding the tax consequences before selling is crucial to avoid unexpected financial burdens.

- Capital Gains Tax: The proceeds from selling a structured settlement are typically taxed as capital gains. This means you may have to pay a portion of your proceeds to the IRS.

- State Taxes: In addition to federal taxes, you may also owe state income taxes on your settlement proceeds.

- Tax Planning: Consult with a qualified tax professional to understand the tax implications of selling your structured settlement and explore strategies for minimizing your tax liability.

Real-Life Example: John, a truck driver who suffered a debilitating injury in an accident, received a structured settlement for his medical expenses and lost wages. He sold his settlement to a company for a lump sum but failed to consider the tax implications. When tax season arrived, he was shocked to learn he owed a substantial amount in capital gains taxes, leaving him with significantly less money than he expected.

Failing to Consider Long-Term Financial Needs

Selling your structured settlement can provide a lump sum of cash, but it’s important to consider your long-term financial needs before making a decision.

- Future Expenses: A structured settlement provides a guaranteed stream of income for the future. Selling your settlement may leave you without a steady income source for essential expenses, such as medical bills, housing, or retirement.

- Inflation: Inflation can erode the value of your settlement over time. Selling your settlement may not provide enough money to cover future expenses, especially if you need to rely on the funds for several years.

- Financial Planning: Consult with a financial advisor to assess your long-term financial needs and determine if selling your settlement is the right decision.

Real-Life Example: Mary, a woman with a chronic illness, received a structured settlement to help cover her ongoing medical expenses. She needed a lump sum for home renovations. She sold her settlement, but she failed to consider her long-term medical needs. Later, she realized she had made a mistake, as she no longer had a guaranteed stream of income to cover her medical expenses, leaving her in a precarious financial situation.

Selling Your Structured Settlement

Selling a structured settlement involves converting future payments into a lump sum of cash. This can be a beneficial option if you need immediate access to funds for various reasons, such as paying off debt, starting a business, or covering unexpected expenses. However, it’s crucial to understand the different options available and their implications before making a decision.

Selling Options

There are three primary ways to sell a structured settlement:

- Factoring Companies: These companies purchase structured settlements for a discounted price, offering you a lump sum upfront. They typically charge a higher discount than other options but provide quick and straightforward transactions.

- Viatical Settlement Providers: These companies specialize in buying life insurance policies, including those attached to structured settlements. They typically offer a higher payout than factoring companies but may have a longer processing time.

- Direct Buyers: Individuals or companies may purchase structured settlements directly, offering a potentially higher payout but with greater risk due to the lack of regulation and oversight.

Comparison of Selling Options

Each option has its own advantages and disadvantages, making it essential to carefully consider your individual needs and circumstances:

| Feature | Factoring Companies | Viatical Settlement Providers | Direct Buyers |

|---|---|---|---|

| Payout | Lower | Higher | Potentially Highest |

| Processing Time | Fast | Moderate | Variable |

| Regulation | Highly Regulated | Moderately Regulated | Limited Regulation |

| Risk | Lower | Moderate | Higher |

| Transparency | High | Moderate | Low |

Factors to Consider Before Selling

Selling a structured settlement is a significant financial decision that should not be taken lightly. It’s crucial to carefully weigh the potential benefits against the potential risks before making a final decision. Understanding the implications of selling your structured settlement is essential for making an informed choice that aligns with your financial goals.

Financial Implications

Selling your structured settlement can provide you with a lump sum of cash, which can be appealing for various reasons. However, it’s important to consider the potential financial implications of this decision.

Tax Implications

Selling your structured settlement will likely result in tax liabilities. The proceeds from the sale are generally considered taxable income, and you will need to pay taxes on the amount you receive. The specific tax implications will depend on your individual circumstances and the laws in your state.

For example, if you sell a structured settlement for $100,000, you may need to pay taxes on the entire $100,000, reducing the net amount you receive.

Future Income Streams

Selling your structured settlement means giving up future payments. This can significantly impact your long-term financial security, especially if you rely on these payments for essential expenses or retirement planning.

For instance, if your structured settlement is designed to provide you with monthly payments for the next 20 years, selling it will eliminate those future income streams.

Questions to Ask Yourself

Before deciding to sell your structured settlement, ask yourself these critical questions:

- What is your current financial situation, and what are your immediate financial needs?

- What are your long-term financial goals, and how will selling your structured settlement affect them?

- Have you explored all other options for obtaining the funds you need, such as loans or alternative investments?

- Do you fully understand the tax implications of selling your structured settlement?

- Have you sought advice from a qualified financial advisor to help you evaluate the pros and cons of selling?

Protecting Yourself During the Sale Process

Selling your structured settlement is a significant financial decision. It’s essential to be aware of the potential risks involved and take steps to protect yourself from scams and fraudulent practices. While many reputable companies offer legitimate services, there are unscrupulous actors who may try to take advantage of your situation.

By understanding the potential pitfalls and implementing safeguards, you can increase your chances of getting a fair deal and maximizing your financial outcome. This section will provide you with valuable tips and strategies to help you navigate the process safely and confidently.

Understanding Potential Scams and Fraudulent Practices

Scammers often target individuals who are vulnerable or in desperate need of cash. They may use high-pressure sales tactics, misleading information, or false promises to entice you into a bad deal. Here are some common scams to be aware of:

- Inflated offers: Scammers may offer you a high upfront payment, but the actual value of the settlement may be significantly lower than advertised. This can leave you with less money in the long run.

- Hidden fees: Be cautious of companies that charge excessive or undisclosed fees. These fees can eat into your profits and leave you with less money than you expected.

- Misleading information: Some companies may misrepresent the terms of the agreement or the potential benefits of selling your settlement. Make sure to read all the documents carefully before signing anything.

Working with Reputable and Experienced Professionals

To protect yourself from scams, it’s crucial to work with reputable and experienced professionals who have a proven track record.

- Check their credentials: Verify that the company is licensed and registered to operate in your state. You can also check their reputation with the Better Business Bureau or other consumer protection organizations.

- Look for experience: Choose a company that has a proven track record of helping people sell their structured settlements. Experience is essential for understanding the complexities of the market and negotiating favorable terms.

- Ask for references: Don’t hesitate to ask for references from previous clients. Talking to people who have used the company’s services can give you valuable insights into their practices and customer service.

Ensuring a Fair and Transparent Offer

To ensure a fair and transparent offer, it’s essential to take these steps:

- Get multiple quotes: Don’t settle for the first offer you receive. Get quotes from multiple companies to compare rates and terms. This will give you a better understanding of the market value of your settlement.

- Review the terms carefully: Before signing any documents, carefully review all the terms and conditions. Pay attention to the interest rates, fees, and any other charges. Make sure you understand the entire agreement before committing to anything.

- Seek legal advice: If you’re unsure about anything, don’t hesitate to consult with a lawyer who specializes in structured settlements. They can review the documents and advise you on your rights and obligations.

Alternatives to Selling

Selling your structured settlement might seem like the only option when you need quick cash, but there are alternatives that could be more beneficial in the long run. These alternatives can provide you with the financial flexibility you need without sacrificing the future security your structured settlement provides. Before you decide to sell, consider exploring these alternatives.

Refinancing

Refinancing your structured settlement allows you to access a lump sum of cash by borrowing against the future payments. Instead of selling your rights to the payments, you essentially take out a loan secured by the future payments. Here are some key points to consider:

- Lower Interest Rates: Refinancing typically offers lower interest rates compared to personal loans, allowing you to manage debt more effectively.

- Maintain Future Payments: You continue to receive the remaining payments, providing financial security for the future.

- Tax Benefits: Interest payments on refinanced structured settlements are often tax-deductible, reducing your overall tax burden.

However, refinancing also comes with potential drawbacks:

- Limited Availability: Not all structured settlements are eligible for refinancing, and qualifying can be challenging.

- Fees and Costs: Refinancing involves various fees and costs, including origination fees, appraisal fees, and closing costs.

- Potential for Debt Accumulation: If you don’t manage the loan responsibly, you could accumulate significant debt, putting your financial stability at risk.

Obtaining a Loan

A personal loan can provide a quick and convenient way to access cash, but it’s crucial to consider the potential drawbacks:

- Higher Interest Rates: Personal loans typically have higher interest rates compared to refinancing options, leading to a higher cost of borrowing.

- Limited Loan Amounts: Personal loan amounts are often capped, limiting the amount of cash you can access.

- No Collateral: Personal loans are unsecured, meaning they are not backed by any asset, which could lead to higher interest rates and stricter eligibility requirements.

While personal loans offer flexibility, they can also come with significant risks:

- Debt Accumulation: High interest rates and repayment terms can lead to significant debt accumulation, making it challenging to manage your finances.

- Impact on Credit Score: Missed payments can negatively impact your credit score, making it difficult to obtain future loans or credit cards.

Table Comparing Alternatives

| Feature | Selling | Refinancing | Personal Loan ||—|—|—|—|| Access to Cash | Immediate lump sum | Lump sum after approval | Immediate lump sum || Future Payments | Lost | Continued | Not affected || Interest Rates | N/A | Typically lower | Typically higher || Fees and Costs | High | Moderate | Moderate || Eligibility | Relatively easy | Can be challenging | Varies based on credit score || Tax Implications | Taxable event | Interest payments may be tax-deductible | Interest payments are typically not tax-deductible |

Selling a structured settlement should never be taken lightly. By carefully evaluating your options, understanding the risks involved, and seeking professional guidance, you can navigate this complex process with confidence. Remember, a well-informed decision today can secure your financial future and ensure that you receive the best possible outcome.

Expert Answers

What are the tax implications of selling a structured settlement?

Selling a structured settlement can result in significant tax consequences. The proceeds from the sale are generally considered taxable income, which could lead to a substantial tax liability. It’s essential to consult with a tax professional to understand the specific tax implications of your situation.

How can I find a reputable structured settlement factoring company?

Research is crucial when choosing a factoring company. Look for companies with a proven track record, positive customer reviews, and transparent pricing. Consider consulting with a financial advisor or attorney for recommendations.

Are there any alternatives to selling my structured settlement?

Yes, you can explore alternatives such as refinancing your settlement or obtaining a loan. These options might offer more favorable terms than selling your settlement outright. It’s advisable to compare the pros and cons of each option before making a decision.