Ever received a structured settlement after an accident or injury? These payments, often spread over years, can be a lifeline but sometimes you need cash now. Selling your structured settlement can provide immediate funds, but how long does this process take?

This guide will explore the factors influencing the sale timeframe, the steps involved, and typical timelines. We’ll also discuss alternatives to selling, ensuring you make the most informed decision for your financial situation.

Understanding Structured Settlements

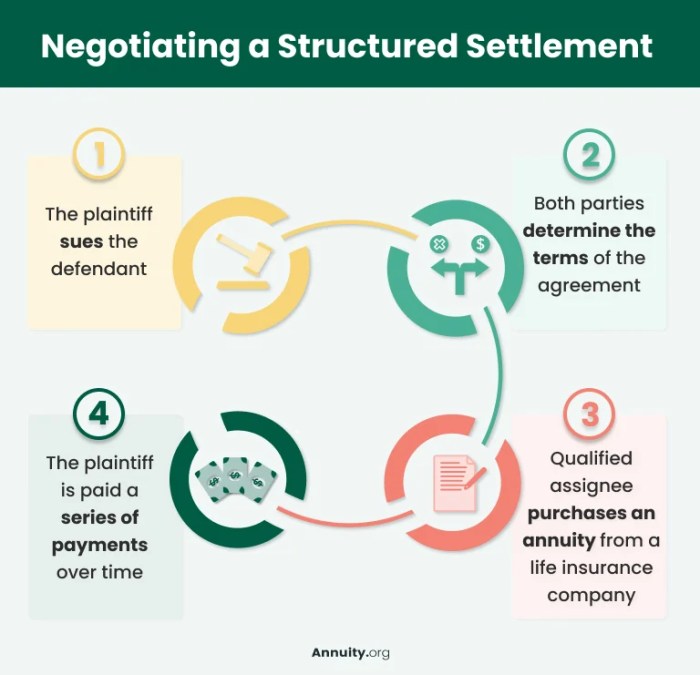

A structured settlement is a legal agreement that provides a person with regular payments over a set period of time. It’s often used as a way to compensate someone for a serious injury or illness, particularly in cases involving lawsuits. Instead of receiving a lump sum payment, the injured party receives a series of payments, typically monthly or annually. These payments are often designed to cover expenses like medical bills, lost wages, and future care.

Types of Situations Where Structured Settlements Are Used

Structured settlements are frequently used in various situations, including:

- Personal Injury Cases: When someone suffers a serious injury due to negligence or an accident, a structured settlement can provide a steady stream of income to cover ongoing medical expenses and lost income.

- Medical Malpractice: In cases where medical negligence leads to harm, structured settlements can help compensate the victim for their injuries and future medical needs.

- Wrongful Death Cases: When a person dies due to another’s negligence, a structured settlement can provide financial support to the surviving family members.

- Product Liability: If a defective product causes injury, a structured settlement can ensure the injured party receives compensation for their damages.

Benefits of Structured Settlements

Structured settlements offer several advantages:

- Guaranteed Income Stream: The regular payments provide a reliable source of income for the recipient, helping them manage their finances and cover expenses.

- Protection from Financial Mismanagement: Receiving payments over time can help prevent the recipient from spending a large sum of money unwisely.

- Tax Advantages: In many cases, the payments from a structured settlement are tax-free, providing a significant financial benefit to the recipient.

- Long-Term Financial Security: Structured settlements can provide financial security for the recipient’s future, especially if they are dealing with long-term medical needs.

Drawbacks of Structured Settlements

While structured settlements have many benefits, there are also some potential drawbacks:

- Lower Present Value: The total amount received in a structured settlement is often less than a lump sum payment due to the time value of money. The present value of future payments is less than the lump sum value.

- Limited Flexibility: The recipient is bound by the terms of the settlement, and they cannot access the full amount of the settlement immediately.

- Inflation: Over time, the purchasing power of the payments may decrease due to inflation, especially if the payments are fixed.

- Difficulty in Modifying Payments: Changing the payment schedule or amount can be difficult and may require legal intervention.

Factors Affecting Sale Time

The time it takes to sell a structured settlement for cash can vary depending on several factors. Understanding these factors can help you make informed decisions and manage your expectations.

The sale process involves a series of steps, including finding a buyer, negotiating a fair price, and completing the legal paperwork. The length of time each step takes can be influenced by various factors, such as the size of the settlement, the payment schedule, and the current market conditions.

Settlement Amount

The amount of the structured settlement is a major factor affecting the sale timeline. Larger settlements are generally more attractive to investors, as they offer a higher potential return.

Investors are more likely to be interested in larger settlements, leading to a faster sale process. However, finding a buyer for smaller settlements might take longer.

Payment Schedule

The payment schedule of the structured settlement also influences the sale time. Settlements with frequent payments are generally more appealing to investors.

Frequent payments provide investors with a steady stream of income, which can be more attractive than waiting for a lump sum payment. Settlements with infrequent payments might take longer to sell, as investors might be hesitant to wait for a long time to receive their returns.

Remaining Payments

The number of remaining payments in the structured settlement is another important factor. Settlements with fewer remaining payments are typically easier to sell.

Investors are more likely to be interested in settlements with a shorter remaining payment period, as they can receive their returns sooner. Settlements with many remaining payments might take longer to sell, as investors might be hesitant to wait for a longer period to recoup their investment.

Market Conditions

The overall market conditions can also impact the sale time. A strong economy with low interest rates can make structured settlements more attractive to investors, leading to faster sales.

In a favorable market, investors are more likely to have capital available for investments, which can increase demand for structured settlements. Conversely, a weak economy with high interest rates can make investors more cautious, potentially slowing down the sale process.

Investor Demand

The level of investor demand for structured settlements can also influence the sale time. High demand can lead to a faster sale, as there are more potential buyers competing for available settlements.

If there are more investors interested in buying structured settlements than available settlements, the sale process can be faster. However, if there is low demand, the sale might take longer, as investors might be less willing to make offers or might negotiate lower prices.

The Sale Process

Selling a structured settlement for cash involves a series of steps designed to ensure a fair and transparent transaction. It’s important to understand the process to make informed decisions and protect your financial interests.

The sale process typically involves the following steps:

The Role of a Structured Settlement Broker

Structured settlement brokers or facilitators play a crucial role in connecting sellers with potential buyers, facilitating the negotiation process, and handling the paperwork involved in the transaction. They act as intermediaries, working to ensure that both parties understand the terms of the sale and that the transaction is completed smoothly.

Here are some key roles of a structured settlement broker:

- Provide information and education: Brokers can explain the intricacies of structured settlements and the process of selling them for cash.

- Evaluate the value of the settlement: Brokers use various methods, such as actuarial calculations, to determine the fair market value of the settlement.

- Find potential buyers: Brokers have networks of investors interested in purchasing structured settlements.

- Negotiate the terms of the sale: Brokers work with both the seller and buyer to reach a mutually agreeable price and terms.

- Handle the paperwork: Brokers manage the legal and administrative aspects of the transaction, ensuring all necessary documents are completed and filed correctly.

Required Documentation and Information

To sell a structured settlement, you’ll need to provide certain documentation and information to the broker. This information is essential for the broker to evaluate the settlement and find a suitable buyer.

Here’s a list of typical documentation and information required:

- Structured settlement agreement: This document Artikels the terms of the original settlement, including the payment schedule, interest rates, and any other relevant details.

- Payment history: This document shows the past payments received from the settlement, providing a track record of the payment schedule.

- Personal information: This includes your name, address, social security number, and other identifying information.

- Financial information: This may include your income, expenses, and debt obligations.

- Medical records: In some cases, medical records may be required to verify the underlying injury or condition that led to the settlement.

Typical Timeframes

The time it takes to sell a structured settlement for cash can vary depending on several factors, including the size of the settlement, the complexity of the case, and the efficiency of the involved parties. It’s crucial to understand the general timelines involved and the potential delays that might occur.

While there is no definitive timeframe, a typical structured settlement sale can take anywhere from a few weeks to several months.

Typical Timeframes for a Structured Settlement Sale

The duration of a structured settlement sale can be categorized into three primary stages:

- Initial Evaluation: This stage involves assessing the settlement, determining its value, and providing a preliminary offer. It usually takes 1-2 weeks.

- Due Diligence and Documentation: This stage includes verifying the settlement details, gathering necessary documentation, and completing legal paperwork. This process can take 2-4 weeks, depending on the complexity of the case and the responsiveness of the parties involved.

- Funding and Closing: Once all documentation is finalized and approved, the funds are transferred to the seller, and the transaction is completed. This stage can take 1-2 weeks.

Potential Delays

Several factors can contribute to delays in the sale process:

- Complex Settlements: Settlements involving multiple payments or beneficiaries can require additional time for due diligence and documentation.

- Missing Documentation: Delays can occur if crucial documents are missing or need to be obtained from third parties.

- Legal Challenges: In rare cases, legal challenges or disputes might arise, extending the timeline for the sale.

- Market Volatility: Fluctuations in the financial market can impact the valuation of the settlement and cause delays in the funding process.

Factors Affecting Sale Time

Certain factors can influence the speed of the sale process:

- Settlement Size: Larger settlements tend to take longer to process due to increased scrutiny and regulatory requirements.

- Seller’s Responsiveness: Promptly providing required documents and information can expedite the process.

- Experience of the Involved Parties: Working with experienced structured settlement brokers and legal professionals can streamline the process and minimize delays.

Selling a structured settlement for cash can be a complex process, but with proper understanding and guidance, it can be a viable option for accessing immediate funds. While the timeframe can vary, knowing the factors involved and potential delays allows you to navigate this process with confidence. Remember, exploring alternatives and consulting with financial advisors can ensure you make the best decision for your unique needs.

Frequently Asked Questions

Is selling a structured settlement always the best option?

No, selling a structured settlement should be considered carefully. It’s important to weigh the benefits of immediate cash against the potential loss of future payments and the impact on your long-term financial plan.

What are the risks involved in selling a structured settlement?

Risks include receiving less than the full value of your settlement, potential tax implications, and the loss of future payments. It’s essential to consult with a financial advisor and understand the potential downsides before proceeding.

Can I sell a structured settlement if I have already received some payments?

Yes, you can often sell a structured settlement even if you have received some payments. However, the remaining value and payment schedule will affect the sale price and timeframe.

How do I find a reputable structured settlement broker?

Look for brokers with experience, positive reviews, and transparency about their fees. You can also check with your state’s insurance department or consumer protection agency for recommendations.