Navigating the world of legal settlements can be complex, especially when it comes to structured settlements. These arrangements, designed to provide a steady stream of income over time, can be a valuable asset, but understanding their true worth is crucial. Whether you’re a recipient of a structured settlement or considering offering one, knowing how to calculate its value is essential for making informed decisions about your financial future.

This guide will delve into the intricacies of structured settlement valuation, exploring the factors that influence their worth and the methods used to calculate their present value. We’ll also examine the role of annuities in securing payments and provide valuable resources for further exploration.

Understanding Structured Settlements

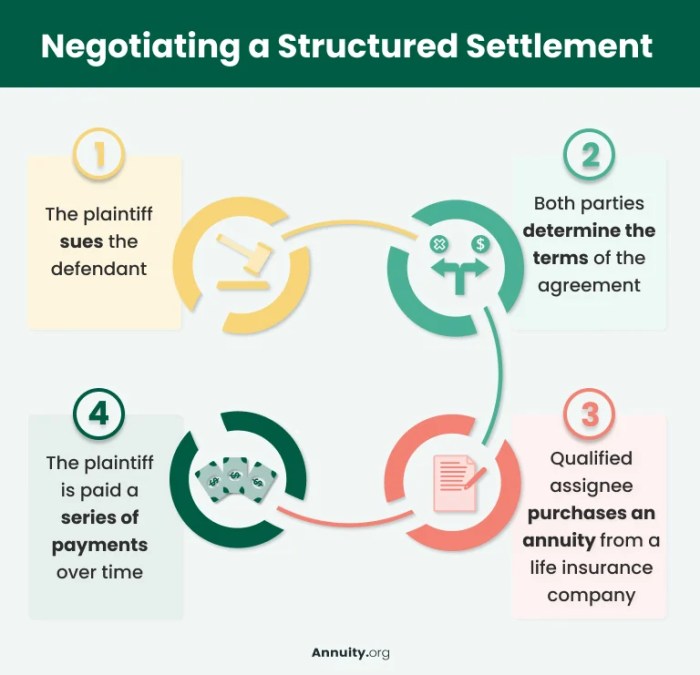

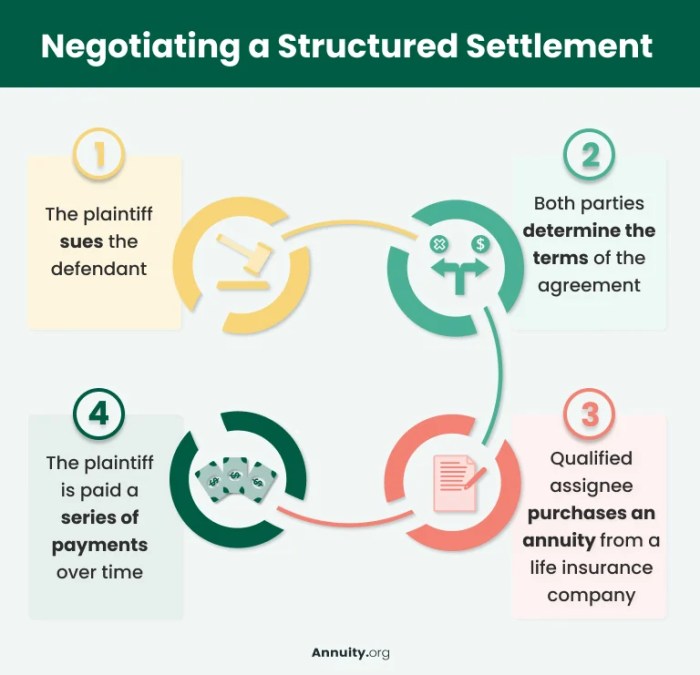

A structured settlement is a legal agreement where a lump-sum payment is divided into a series of payments over a period of time. This arrangement offers a structured approach to managing funds, providing a steady stream of income instead of a single, potentially overwhelming, sum.

Types of Structured Settlements

Structured settlements offer various payment structures tailored to individual needs and circumstances.

- Lump-sum payments: In this type, the entire settlement amount is paid in one single payment. While providing immediate access to funds, it might not be suitable for long-term financial planning.

- Periodic payments: This option involves receiving regular payments, usually monthly or annually, for a predetermined duration. It ensures a consistent income stream, making it ideal for long-term financial security.

- Combinations: This approach blends both lump-sum and periodic payments, allowing for flexibility in managing funds. For instance, a portion of the settlement could be paid upfront as a lump sum, while the remaining amount is distributed through periodic payments.

Scenarios for Structured Settlements

Structured settlements are commonly employed in various situations, including:

- Personal Injury Cases: In cases involving personal injury, structured settlements can provide financial support for medical expenses, lost wages, and future care needs.

- Wrongful Death Cases: These settlements offer financial security for the surviving family members, ensuring their financial stability during a difficult time.

- Medical Malpractice Cases: When medical negligence results in harm, structured settlements can compensate for medical expenses, lost income, and future care.

- Product Liability Cases: In cases involving defective products causing injury, structured settlements can provide financial compensation for the injured party.

Factors Affecting Settlement Value

The value of a structured settlement is determined by a number of factors, including the amount of the settlement, the duration of payments, and the interest rate.

Impact of Key Factors

The value of a structured settlement is influenced by several key factors:

- Amount of the Settlement: The total amount of the settlement is a primary determinant of its value. A larger settlement will naturally result in a higher value.

- Duration of Payments: The length of time over which payments are made also plays a significant role. A longer payment period will generally result in a higher value, as the payments accrue interest over a longer period.

- Interest Rate: The interest rate applied to the settlement affects the value of future payments. A higher interest rate will lead to a higher value, as the payments will grow more quickly over time.

Inflation

Inflation can erode the purchasing power of future payments, impacting the value of a structured settlement.

The rate of inflation can impact the value of a structured settlement, especially over long periods.

For example, a $100,000 settlement with payments spread over 20 years may not have the same purchasing power in the future due to inflation.

Taxes

Structured settlements are generally subject to income tax, which can reduce their overall value.

Tax implications can significantly affect the overall value of a structured settlement.

It is important to consult with a tax professional to understand the tax implications of a structured settlement.

Structured Settlement vs. Lump-Sum Payment

The value of a structured settlement is often compared to the value of a lump-sum payment.

- Lump-Sum Payment: Offers immediate access to the full settlement amount, but it can be easily spent or mismanaged.

- Structured Settlement: Provides a stream of income over time, which can help ensure financial stability and prevent the risk of financial mismanagement.

The choice between a structured settlement and a lump-sum payment depends on individual circumstances and financial goals.

Methods for Calculating Settlement Value

Calculating the present value of a structured settlement involves determining its worth today, considering future payments. This is crucial for understanding the true financial value of the settlement and making informed decisions, such as selling it or using it as collateral for a loan. There are various methods used to calculate this value, each with its own advantages and limitations.

Discounting Cash Flows

This method involves discounting each future payment to its present value, considering the time value of money. The time value of money principle recognizes that money today is worth more than the same amount of money in the future, due to the potential for earning interest or returns.

- Discount Rate: The discount rate is a crucial factor in this method. It represents the expected rate of return on an investment with similar risk and maturity. This rate can vary based on market conditions, inflation, and the risk associated with the settlement.

- Formula: The present value (PV) of a future payment (FV) is calculated using the following formula:

PV = FV / (1 + r)^n

Where:

- r is the discount rate

- n is the number of periods until the payment is received

- Example: Assume a structured settlement promises a payment of $100,000 in five years, and the discount rate is 5%. The present value of this payment would be:

PV = $100,000 / (1 + 0.05)^5 = $78,352.62

This method considers the time value of money and provides a realistic estimate of the settlement’s worth. However, it relies on choosing an appropriate discount rate, which can be subjective and influenced by market conditions.

Using Actuarial Tables

Actuarial tables provide pre-calculated present values for different payment streams, considering factors like age, mortality rates, and interest rates. These tables are used by insurance companies and financial institutions to determine the value of annuities and other financial products.

- Mortality Rates: Actuarial tables incorporate mortality rates to account for the possibility of the recipient’s death before receiving all payments.

- Interest Rates: They also consider interest rates to reflect the time value of money.

- Procedure: To calculate the present value using actuarial tables, you would identify the appropriate table based on the recipient’s age and the payment schedule. Then, you would find the corresponding present value factor for each payment and multiply it by the payment amount.

This method is widely used in the structured settlement industry and provides a standardized approach to valuation. However, it relies on assumptions about mortality rates and interest rates, which may not accurately reflect individual circumstances or future market conditions.

Other Methods

In addition to the above methods, other techniques can be used to calculate the present value of a structured settlement. These methods may include:

- Capitalization of Income: This method involves estimating the future income stream generated by the settlement and capitalizing it to its present value.

- Market Analysis: This approach considers the prices of similar structured settlements that have been sold in the market to determine the value of the current settlement.

These alternative methods provide additional perspectives on valuation but may be less widely used or require specialized expertise.

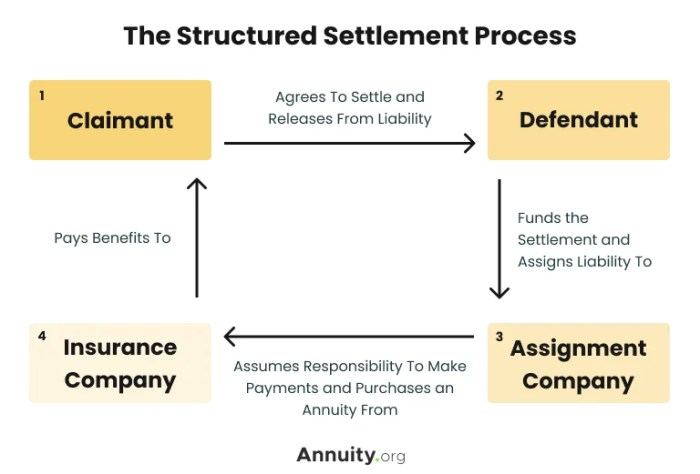

Structured Settlement Annuities

Structured settlement annuities are the cornerstone of securing the payments promised in a structured settlement. They are financial instruments designed to guarantee the timely disbursement of funds over a specified period, often spanning years or even decades. These annuities essentially act as a promise from the insurance company to make regular payments to the recipient, ensuring that the settlement funds are protected and available when needed.

How Annuities Work and Their Impact on Settlement Value

Annuities play a crucial role in determining the overall value of a structured settlement. The present value of the future payments is calculated based on the annuity’s interest rate and the length of the payment schedule. This present value represents the lump sum equivalent of the structured settlement.

The present value of a structured settlement is calculated using the following formula:Present Value = Payment Amount x Annuity Factor

The annuity factor is a mathematical calculation that considers the interest rate and the time value of money. It essentially discounts the future payments to their present value, taking into account the fact that money today is worth more than money in the future due to the potential for investment growth.

Advantages and Disadvantages of Using Annuities in Structured Settlements

Annuities offer several advantages in structured settlements:

- Guaranteed Payments: Annuities provide certainty and security, guaranteeing that the recipient will receive the promised payments, regardless of market fluctuations or personal circumstances.

- Tax Advantages: Payments from structured settlement annuities are typically tax-free, making them an attractive option for maximizing the after-tax value of the settlement.

- Protection from Mismanagement: Annuities shield the settlement funds from potential misuse or mismanagement by the recipient, ensuring that the money is used for its intended purpose.

- Flexibility: Annuities can be structured to meet specific needs, allowing for various payment schedules, lump sum options, and even adjustments for inflation.

However, there are also some potential drawbacks to consider:

- Limited Flexibility: Once the annuity is established, it can be difficult to modify or change the payment schedule, limiting the recipient’s ability to adapt to future needs.

- Interest Rate Risk: If interest rates rise after the annuity is purchased, the present value of the settlement may be lower than it would have been if the annuity had been purchased at a later date.

- Potential for Early Termination: In some cases, the recipient may be able to terminate the annuity early, but this may result in a penalty or a reduced payout.

Valuation Tools and Resources

Determining the precise value of a structured settlement can be complex, involving various factors and calculations. Fortunately, several resources and tools can assist in estimating the value of a structured settlement, providing valuable insights for decision-making.

Online Calculators and Software Tools

Online calculators and software tools can provide a preliminary estimate of a structured settlement’s value. These tools often require basic information about the settlement, such as the total amount, payment schedule, and interest rate. While these tools offer a starting point, it’s essential to remember that they provide estimates and may not account for all the complexities of a structured settlement.

- Structured Settlement Calculator: These calculators are readily available online and allow users to input the relevant details of a structured settlement. The calculator then generates an estimated present value of the settlement based on the provided information.

- Structured Settlement Software: More comprehensive software programs are also available that provide more in-depth analysis and calculations. These programs often include features like discounting future payments to present value, factoring in inflation, and calculating the impact of different investment scenarios.

Reputable Financial Advisors and Professionals

For a more accurate and comprehensive valuation, consulting with a financial advisor or professional specializing in structured settlements is highly recommended. These professionals possess the expertise and experience to analyze the specifics of a structured settlement and provide a reliable valuation.

- Structured Settlement Brokers: These professionals specialize in buying and selling structured settlements. They have extensive knowledge of the market and can provide accurate valuations based on their experience and access to relevant data.

- Financial Planners: Financial planners can offer comprehensive financial advice, including guidance on structured settlement valuation. They can analyze the settlement in the context of your overall financial goals and provide recommendations based on your individual circumstances.

- Attorneys: Attorneys specializing in structured settlements can provide legal advice and representation regarding the valuation and sale of a settlement. They can ensure that your rights are protected and that you receive a fair valuation.

Resources for Guidance and Information

Numerous resources offer guidance and information on structured settlements and their valuation. These resources can provide valuable insights into the process, legal considerations, and available options.

- The National Structured Settlements Trade Association (NSSTA): The NSSTA is a professional organization dedicated to promoting ethical practices and providing information about structured settlements. Their website offers resources for consumers, including articles, FAQs, and a directory of members.

- The American Bar Association (ABA): The ABA’s website offers resources and information on various legal topics, including structured settlements. Their website provides information on the legal aspects of structured settlements, including valuation, taxation, and transferability.

- Government Agencies: Government agencies, such as the Internal Revenue Service (IRS), can provide information on the tax implications of structured settlements. It is crucial to understand the tax implications of a structured settlement before making any decisions about selling or transferring it.

By understanding the factors that influence the value of a structured settlement, the methods used to calculate it, and the resources available for guidance, you can confidently navigate the process of evaluating these financial arrangements. Whether you’re seeking to maximize the value of your settlement or ensure its fair assessment, the knowledge gained from this guide will empower you to make informed decisions that align with your financial goals.

Question Bank

What are the benefits of a structured settlement?

Structured settlements offer several benefits, including guaranteed income, protection from financial mismanagement, and tax advantages. They can provide long-term financial stability, particularly for individuals with ongoing medical expenses or disability needs.

Can I sell my structured settlement?

Yes, you can sell your structured settlement to a third-party company that specializes in purchasing these types of payments. However, it’s crucial to understand that you’ll likely receive less than the full present value of the settlement.

How often are structured settlements paid out?

The frequency of payments in a structured settlement can vary depending on the agreement. Payments can be made monthly, quarterly, annually, or in a combination of frequencies.

What are the tax implications of a structured settlement?

The tax implications of a structured settlement depend on the specific circumstances. Generally, payments received from a structured settlement are not taxed as income, but there may be exceptions. It’s essential to consult with a tax advisor to understand the tax treatment of your specific settlement.