Navigating the world of structured settlements can be a complex process, especially when considering selling your future payments. Understanding how to find a reputable company to buy your structured settlement is crucial for ensuring a fair and secure transaction. This guide will equip you with the knowledge and tools to make informed decisions and protect your financial well-being.

A structured settlement is a legal agreement that pays out a lump sum of money in regular installments over a period of time. This can be a valuable tool for individuals who have received a significant settlement, such as a personal injury award. However, sometimes it may be more beneficial to receive a lump sum payment instead of waiting for regular installments.

This is where the option to sell your structured settlement comes in. But, selling your structured settlement requires careful consideration and a deep understanding of the process.

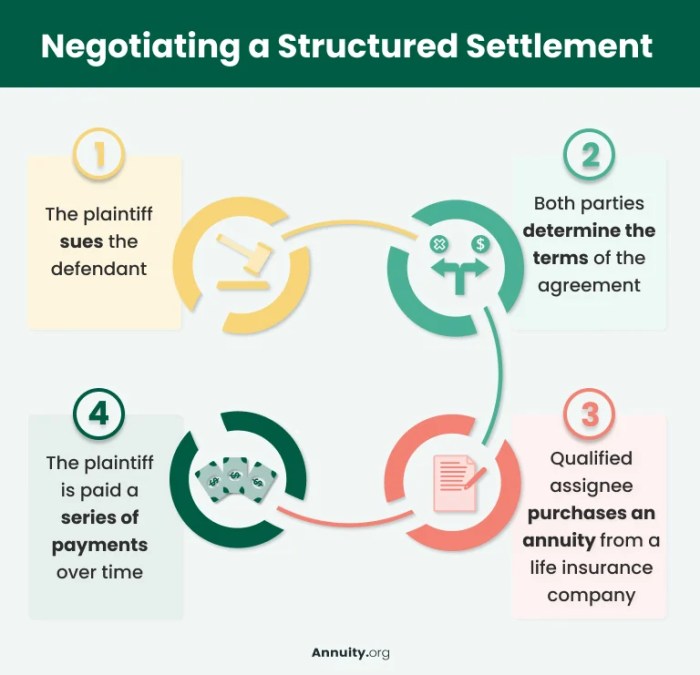

Understanding Structured Settlements

Structured settlements are a unique type of financial arrangement used to compensate individuals who have suffered significant injuries or losses. Instead of receiving a lump sum payment, the injured party receives a series of regular payments over a predetermined period. These payments can be structured in various ways, such as monthly installments, annual payments, or a combination of both.

Purpose of Structured Settlements

Structured settlements serve a crucial purpose in providing financial security and stability to individuals who have experienced life-altering events. They are designed to ensure that the injured party has a steady stream of income to cover their ongoing expenses, such as medical bills, living costs, and lost wages. This structured approach offers several advantages over a lump sum payment, particularly for individuals who may struggle with managing large sums of money or who require ongoing financial support.

Benefits of Structured Settlements

- Guaranteed Income Stream: Structured settlements provide a guaranteed source of income for the recipient, eliminating the risk of running out of funds prematurely. This predictability offers peace of mind and financial stability, especially for individuals who may face long-term medical expenses or disability.

- Protection from Financial Mismanagement: Receiving regular payments instead of a lump sum can help prevent financial mismanagement or unwise investments. This is particularly beneficial for individuals who may lack financial experience or who are vulnerable to financial exploitation.

- Tax Advantages: In many cases, structured settlement payments are tax-free, providing significant financial savings for the recipient. This tax-free status can make structured settlements a more attractive option compared to other forms of compensation.

- Flexibility in Payment Structure: Structured settlements can be tailored to the specific needs of the recipient. Payments can be adjusted based on factors such as age, medical expenses, and future income projections. This flexibility ensures that the recipient receives the appropriate level of financial support over time.

Drawbacks of Structured Settlements

- Limited Access to Funds: The structured nature of these settlements restricts the recipient’s access to the full amount of compensation upfront. This can be a drawback for individuals who require immediate access to funds for specific purposes, such as purchasing a home or starting a business.

- Potential for Inflation: Over time, the value of structured settlement payments can be eroded by inflation. This means that the recipient may receive less purchasing power in the future compared to the initial value of the settlement.

- Difficulty in Selling or Transferring: Selling or transferring a structured settlement can be challenging and often involves significant fees and legal complexities. This can limit the recipient’s options for accessing or using the settlement funds as needed.

Scenarios Where Structured Settlements are Commonly Used

Structured settlements are frequently employed in various legal and insurance contexts. Some common scenarios include:

- Personal Injury Cases: In cases involving serious injuries, such as car accidents, slip and falls, or medical negligence, structured settlements provide a reliable source of income for individuals who may face long-term medical expenses, lost wages, and disability.

- Wrongful Death Claims: When a wrongful death occurs, structured settlements can provide financial support to the surviving family members, ensuring their financial stability during a difficult time.

- Product Liability Cases: In cases involving defective products that cause injuries or death, structured settlements can compensate victims for their losses and provide ongoing financial support.

- Medical Malpractice Claims: When medical negligence results in significant injuries or death, structured settlements can provide financial compensation and ensure ongoing care for the affected individuals.

Recognizing Reputable Companies

Selling your structured settlement is a significant financial decision, and it’s crucial to partner with a reputable company. Choosing the wrong company can lead to a lower payout, hidden fees, and potential legal issues. Here’s what to look for when evaluating a structured settlement purchasing company:

Licensing and Regulatory Compliance

It’s essential to ensure that the company you’re considering is properly licensed and complies with all relevant regulations. Licensing and compliance demonstrate that the company operates within a framework designed to protect consumers.

- State Licensing: Most states require structured settlement purchasing companies to be licensed. You can verify a company’s license by contacting your state’s Department of Insurance or checking their website.

- Financial Stability: Reputable companies will be financially stable and transparent about their financial health. They should have a proven track record of successfully handling structured settlement transactions.

- Regulatory Compliance: Check if the company adheres to regulations set by the Structured Settlement Protection Act (SSPA) and other relevant legislation. The SSPA aims to ensure fair and transparent transactions and protect consumers from unfair practices.

Company Reputation and Track Record

Beyond licensing and compliance, it’s crucial to evaluate a company’s reputation and track record. This provides insight into their business practices, customer satisfaction, and overall reliability.

- Online Reviews and Testimonials: Check online review sites like Trustpilot, Google Reviews, and the Better Business Bureau (BBB) to see what other customers have said about the company. Look for consistent positive reviews and a lack of significant complaints.

- Industry Associations: Reputable companies often belong to industry associations like the National Association of Settlement Purchasers (NASP). Membership in such associations can indicate a commitment to ethical business practices and adherence to industry standards.

- Legal History: Research the company’s legal history to see if they’ve been involved in any lawsuits or complaints. A clean legal record is a positive indicator.

Transparency and Communication

Reputable companies are transparent about their fees, terms, and the entire transaction process. They should be open to answering your questions and providing clear, concise information.

“Transparency is key. A reputable company will provide detailed information about their fees, the purchase process, and their track record.”

- Clear Fee Structure: The company should provide a detailed breakdown of all fees, including origination fees, processing fees, and any other charges. Avoid companies that have hidden fees or vague fee structures.

- Open Communication: The company should be responsive to your questions and concerns. They should be willing to explain the transaction process in detail and address any doubts you may have.

- Written Agreement: Insist on a written agreement that clearly Artikels the terms of the purchase, including the purchase price, fees, and the timeline for the transaction.

Evaluating Company Offerings

Once you’ve identified a few reputable companies, it’s time to compare their offers. Each company will likely present a unique purchase price based on their internal valuation of your structured settlement. Understanding the factors that influence these prices is crucial to making an informed decision.

Factors Influencing Purchase Price

The purchase price of your structured settlement is determined by several factors, primarily interest rates and discount rates.

- Interest Rates: The prevailing interest rates in the market play a significant role in determining the purchase price. Companies use these rates to calculate the present value of your future payments. Higher interest rates mean a lower present value of your future payments, resulting in a lower purchase price. For instance, if interest rates are high, a company will need to offer a lower lump sum to generate a return equivalent to investing that sum at the current interest rate.

- Discount Rates: Companies apply a discount rate to account for the risk associated with purchasing your structured settlement. This rate reflects the potential for unforeseen events, such as changes in interest rates or the recipient’s health, that could affect the value of the payments. Higher discount rates lead to lower purchase prices.

Calculating Fair Market Value

Determining the fair market value of your structured settlement involves assessing the present value of your future payments. This calculation considers the following:

- Payment Amount: The amount of each payment and the frequency of payments are essential factors.

- Payment Duration: The length of the payment period directly impacts the total value of the settlement.

- Interest Rates: As mentioned earlier, prevailing interest rates play a crucial role in calculating the present value.

- Discount Rates: The discount rate applied by the company reflects their assessment of the risk associated with purchasing your structured settlement.

The fair market value is typically calculated using a discounted cash flow (DCF) analysis. This involves projecting future payments and discounting them back to their present value using a chosen discount rate.

It’s important to note that different companies may use different discount rates and methodologies, resulting in variations in their purchase price offers. Therefore, comparing offers from multiple companies is crucial to ensure you receive a fair price.

Researching and Due Diligence

Before you decide to sell your structured settlement, it’s crucial to conduct thorough research and due diligence. This process involves carefully evaluating different companies and their offerings to ensure you’re making an informed and beneficial decision.

Understanding Contract Terms and Conditions

Reading and understanding all the contract terms and conditions is essential. This includes the purchase price, any fees or commissions, the payment schedule, and any potential risks involved.

- Purchase Price: The purchase price should be competitive and reflect the fair market value of your structured settlement payments. You should compare offers from different companies to ensure you’re getting a fair deal.

- Fees and Commissions: Be aware of any fees or commissions associated with the transaction. These can include upfront fees, closing costs, and ongoing management fees. Make sure you understand what these fees cover and whether they are reasonable.

- Payment Schedule: The contract should clearly Artikel the payment schedule. This includes the amount you will receive, the frequency of payments, and the total amount you will receive over the life of the agreement.

- Risks: There are potential risks associated with selling your structured settlement. These risks can include the company going bankrupt, the value of your settlement decreasing, or changes in tax laws. Make sure you understand these risks before you make a decision.

The Role of Independent Financial Advisors

Independent financial advisors can play a vital role in evaluating structured settlement offers. They can provide unbiased advice and help you understand the complexities of the transaction.

- Expertise: Financial advisors have expertise in financial planning and investment strategies. They can help you assess the financial implications of selling your structured settlement and determine if it’s the right decision for your specific circumstances.

- Objectivity: Independent financial advisors are not affiliated with any structured settlement purchasing companies. This ensures that their advice is objective and not influenced by any financial incentives.

- Negotiation Support: A financial advisor can help you negotiate the best possible terms with the purchasing company. They can help you understand the contract and ensure that you are protected.

Avoiding Scams and Misleading Practices

The decision to sell a structured settlement is a significant financial one. It’s crucial to navigate this process with caution, as unscrupulous companies may try to exploit vulnerable individuals. Understanding common red flags and protecting yourself from potential scams is essential for making informed and safe choices.

Identifying Red Flags

Recognizing warning signs can help you avoid falling prey to fraudulent practices. Here are some key indicators that should raise your suspicions:

- Unrealistic promises of high payouts: Be wary of companies offering significantly higher amounts than other reputable firms. These promises are often too good to be true and may be a tactic to lure you in.

- High-pressure sales tactics: Legitimate companies will provide you with time and space to make a decision. If a company pressures you to sign contracts immediately or makes you feel uncomfortable, it’s a red flag.

- Lack of transparency: Reputable companies will openly disclose all fees and charges associated with the transaction. If a company is vague about its fees or refuses to provide detailed information, it’s a sign of potential trouble.

- Negative online reviews: Before engaging with any company, check online reviews from previous clients. Look for patterns of complaints about unethical practices, hidden fees, or poor customer service.

- Unsolicited contact: If you receive unsolicited calls or emails from companies offering to buy your structured settlement, be cautious. Legitimate companies typically work with attorneys or brokers who refer clients to them.

Tactics Used by Fraudulent Companies

Fraudulent companies employ various tactics to deceive unsuspecting individuals. Here are some common methods:

- Misrepresenting their expertise: Some companies may falsely claim to have specialized knowledge of structured settlements or portray themselves as having close ties to legal professionals.

- Offering misleading or exaggerated valuations: Fraudulent companies may inflate the value of your settlement to entice you with a seemingly lucrative offer, only to deduct substantial fees later.

- Pressuring you into making quick decisions: They may create a sense of urgency, claiming that the offer is only valid for a limited time, to prevent you from seeking professional advice.

- Hiding important details: They may omit crucial information about fees, charges, or the actual amount you’ll receive after all deductions, leading to unexpected financial burdens.

- Using high-pressure sales techniques: They may use aggressive tactics, such as repeated calls, intimidation, or emotional manipulation, to pressure you into making a decision before you’re ready.

Protecting Yourself from Scams

Taking proactive steps can help you safeguard your interests and avoid falling victim to scams:

- Research thoroughly: Before engaging with any company, research their reputation, licensing, and track record. Check online reviews, contact the Better Business Bureau, and consult with legal professionals.

- Seek professional advice: Consult with an attorney specializing in structured settlements to understand your rights and options. They can help you evaluate offers and negotiate favorable terms.

- Compare multiple offers: Don’t settle for the first offer you receive. Compare offers from different companies and choose the one that provides the best terms and transparency.

- Read all documents carefully: Before signing any contracts, read all documents thoroughly and understand the terms and conditions. Don’t hesitate to ask questions and clarify any uncertainties.

- Trust your instincts: If you feel pressured, uncomfortable, or uncertain about any aspect of the process, trust your instincts and walk away. It’s better to be safe than sorry.

Choosing the Right Company

Now that you understand structured settlements and have a good grasp of what to look for in a reputable company, it’s time to narrow down your options and choose the best fit for your needs. This decision is crucial, as it directly impacts the amount of money you receive and the overall experience of selling your structured settlement.

Selecting the right company involves carefully considering various factors, including their reputation, experience, pricing, and communication style. You’ll want to ensure they are transparent, ethical, and provide a smooth and secure transaction process. Let’s delve into some key factors to guide you in your decision-making.

Company Reputation and Experience

A company’s reputation is paramount when considering a structured settlement purchase. It’s essential to research their track record, customer reviews, and industry standing. Look for companies with a proven history of fair and transparent transactions. You can find this information on websites like the Better Business Bureau (BBB) or through online reviews. Additionally, inquire about their experience in handling structured settlements, their expertise in valuation, and their understanding of the legal complexities involved.

- Check for BBB Accreditation: The BBB offers accreditation to businesses that meet specific standards of ethical conduct and customer service. Look for companies that are BBB accredited and have a good rating.

- Read Customer Reviews: Websites like Trustpilot and Google Reviews provide valuable insights into customer experiences with different companies. Pay attention to both positive and negative reviews to get a balanced perspective.

- Research Industry Recognition: Look for companies that have received industry awards or recognition for their services. This can indicate their commitment to excellence and their standing within the structured settlement industry.

Transparency and Clear Communication

Transparency is crucial in any financial transaction, especially when dealing with a structured settlement. Choose a company that is upfront about its fees, processes, and any potential risks involved. They should be readily available to answer your questions, provide clear explanations, and address any concerns you might have. Effective communication is key to ensuring a smooth and stress-free experience.

- Ask for a Detailed Breakdown of Fees: Inquire about all associated fees, including upfront fees, processing fees, and any other charges. Ensure you understand the full cost of the transaction before making a decision.

- Request a Clear Explanation of the Process: Ask for a step-by-step explanation of how the transaction will be handled, including the timeline, documentation requirements, and any legal aspects involved.

- Assess Communication Channels: Look for companies that offer multiple communication channels, such as phone, email, and live chat. This allows you to choose the method that best suits your preference.

Ethical Business Practices

Choosing a company with strong ethical business practices is crucial. Look for companies that are committed to fair pricing, honest representation, and responsible financial practices. They should prioritize your interests and ensure a fair and ethical transaction.

- Avoid Companies with High-Pressure Sales Tactics: Be wary of companies that use aggressive or pushy sales tactics. Reputable companies will provide you with the information you need to make an informed decision without pressuring you into a hasty transaction.

- Verify Licensing and Compliance: Ensure the company is properly licensed and complies with all relevant state and federal regulations. This indicates their commitment to ethical business practices and customer protection.

- Consider Membership in Industry Associations: Look for companies that are members of reputable industry associations, such as the National Association of Settlement Purchasers (NASP). This demonstrates their commitment to industry standards and ethical conduct.

Finding a reputable company to buy your structured settlement is a critical step in ensuring a fair and transparent transaction. By conducting thorough research, understanding the company’s credentials, and carefully reviewing all terms and conditions, you can protect yourself from scams and make an informed decision. Remember, taking the time to understand the process and choose a reputable company will ultimately lead to a more positive outcome and financial security.

Essential Questionnaire

What are the risks of selling my structured settlement?

Selling your structured settlement can involve risks, such as receiving a lower purchase price than expected, encountering fraudulent companies, or facing legal challenges. It’s crucial to thoroughly research and understand the risks involved before making a decision.

How do I know if a company is reputable?

Look for companies that are licensed and regulated, have a proven track record, and offer transparent and clear terms and conditions. You can also check with the Better Business Bureau and other consumer protection agencies for any complaints or negative reviews.

What should I ask a company before selling my structured settlement?

Ask about their experience, licensing, fees, payment terms, and how they determine the purchase price. Don’t hesitate to ask for clarification on any aspect of the process that you don’t understand.